Venture Capital Prospecting: How To Raise a VC Fund [Part I]

The Seraf Compass

MAY 10, 2023

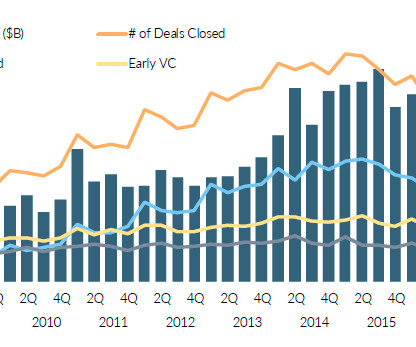

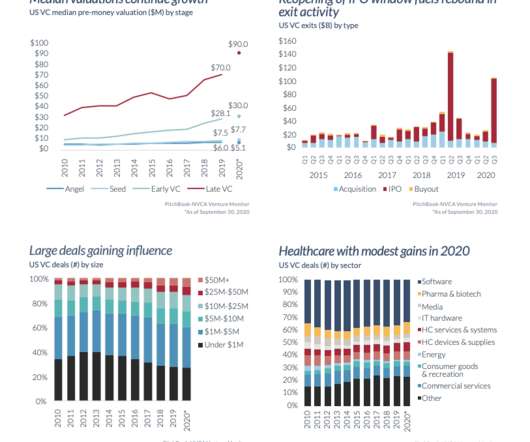

One of the biggest trends we witnessed over the past few years is the rapid pace of new early stage venture fund formation combined with significant growth in the amount of capital invested. These days, funds are popping up almost everywhere.

Let's personalize your content