A Great Discussion with @skupor @davemcclure @msuster on Changes in the VC Industry

Both Sides of the Table

JULY 27, 2014

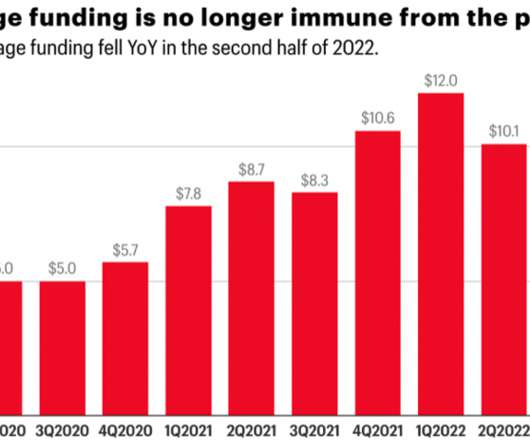

Scott and I agree on nearly everything: The VC structure is changing and there appears to be a bifurcation into small & large VCs with an impact on “traditionally sized” VCs. The only point we didn’t seem totally aligned on was what we happening to the “middle of the VC market.”

Let's personalize your content