A Weird and Wacky Approach To Angel Investing

OnStartups

MARCH 24, 2021

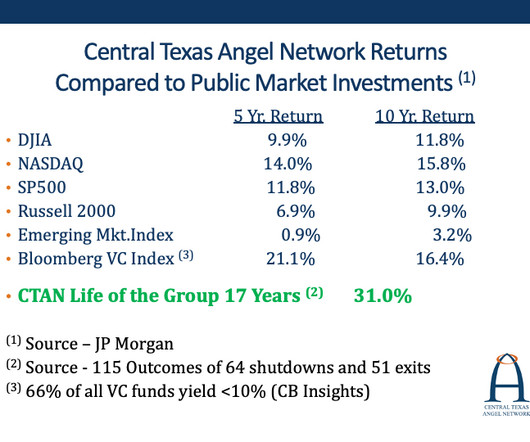

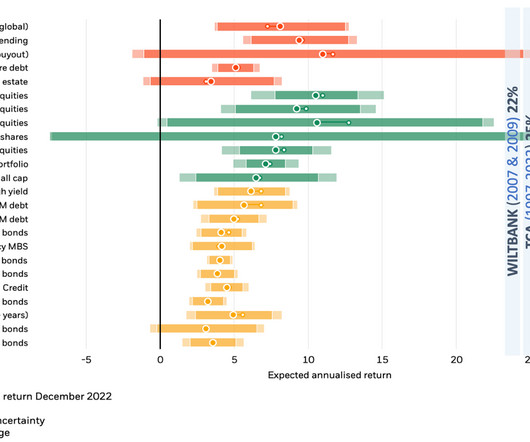

An Odd Start To My Angel Investing. So I thought of an idea: Why not invest in startups? Angel investing is like having a niece or nephew. I then wrote a seed round investment check of $500,000 to HubSpot. This presented a dilemma for my fledgling role as an angel investor. We were off to the races!

Let's personalize your content