Twitter co-founder Biz Stone joins board of audiovisual startup Chroma

TechCrunch

JANUARY 27, 2023

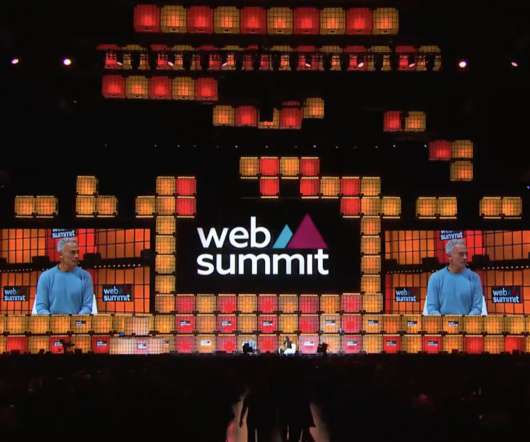

Chroma , a startup working to build a new type of audiovisual entertainment specifically for mobile devices, is now adding a Twitter co-founder to its board. An early Google employee, Stone worked on the Blogger team after its acquisition, ahead of helping co-found Twitter in 2006. million in seed funding (5.1

Let's personalize your content