Innovation, Investment, and Impact: A Journey with Dr Dan Swan in the Techstars Era

AsiaTechDaily

JANUARY 4, 2024

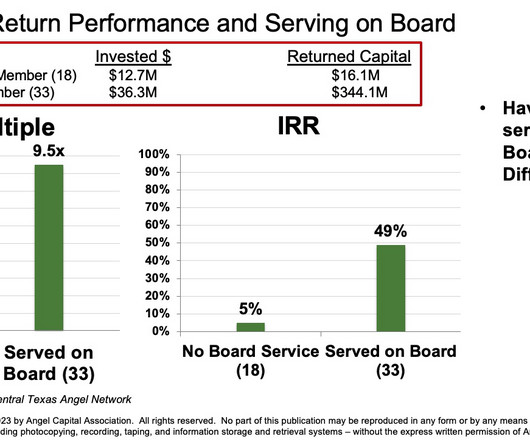

Techstars, established in 2006, stands as one of the most active pre-seed investors, having extended support to over 3,800 companies. The company aims to facilitate a broader flow of capital to entrepreneurs worldwide, ensuring remarkable returns for investors. On average, an impressive 74.5% On average, an impressive 74.5%

Let's personalize your content