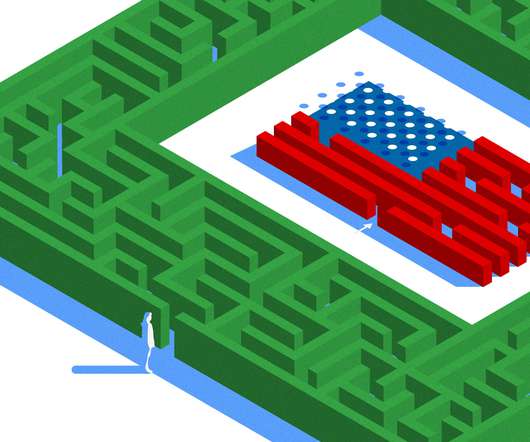

Techstars Launches Accelerator Program in Japan with Mitsui Fudosan and JETRO

AsiaTechDaily

DECEMBER 13, 2023

This collaboration, known as Techstars Tokyo, aims to support early-stage companies with a global perspective, providing assistance to entrepreneurs eyeing international expansion or seeking entry into the Japanese market. Mitsui Fudosan, through its venture arm 31VENTURES, is actively engaged in promoting startup innovation globally.

Let's personalize your content