One woman’s path to financial empowerment leads the way

Young Leaders of the Americas Initiative

MARCH 31, 2020

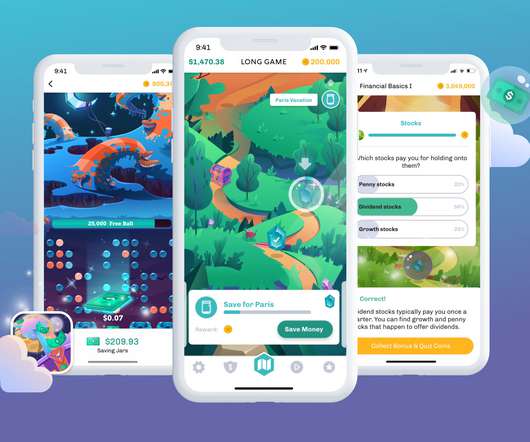

2018 YLAI fellow Kenishia Mais is the founder of ThrivingDollars , a financial education platform empowering young adults with the tools and resources they need to make smarter decisions, create their ideal financial lives, and gain the freedom to pursue more of what they love.

Let's personalize your content