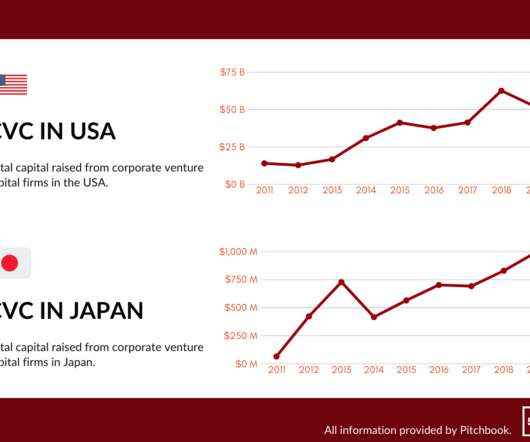

The Value of the 500 Seed Accelerator in 2019

500

DECEMBER 20, 2019

Over the past nine years, the venture capital landscape has dramatically changed. The post The Value of the 500 Seed Accelerator in 2019 appeared first on 500 Startups. What previously defined a “seed” stage is no longer the case, as the average seed investment has gone from $0.5M We’ve also seen an ever-expanding set of options for.

Let's personalize your content