How African startups raised venture capital in 2022

TechCrunch

JANUARY 27, 2023

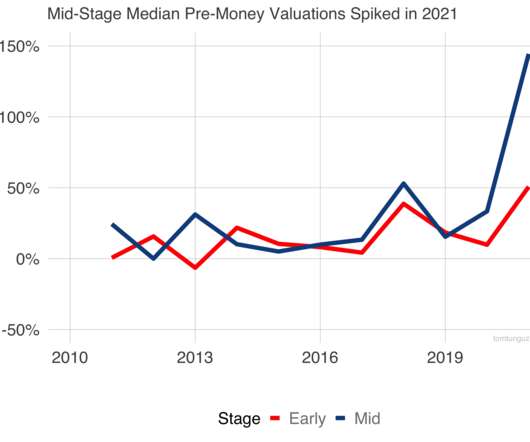

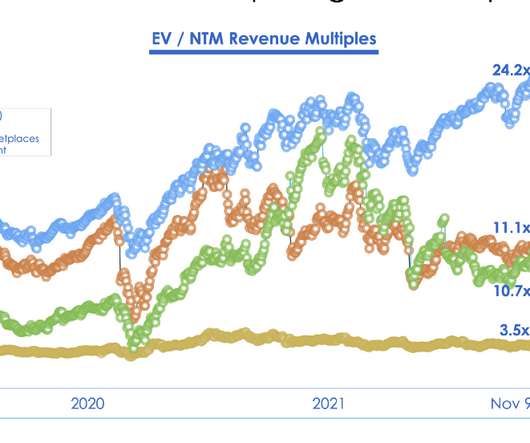

Earlier this month, we reported that investors’ sentiments surrounding venture capital activity going into this were more reserved than upbeat. Investors believe the market correction, which caught up with the continent in the second half of 2022, will spiral into this year. There was reason to believe so. Briter Bridges recorded $5.2

Let's personalize your content