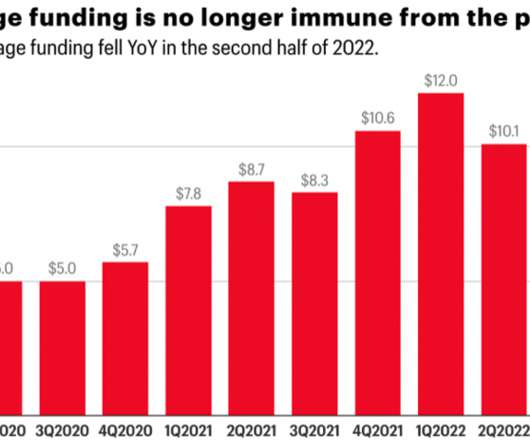

Should Founders Still Raise in an Economic Downturn?

Dream It

APRIL 8, 2020

Runway is a crucial indicator of survival that signifies your company’s future financial ability to sustain operations. If you cannot sustain operations for 18 months, cut your burn rate so you can extend your runway. Investors want to see you’re able to remain lean and adapt to changing economic circumstances.

Let's personalize your content