A Guide To Angel Investing Documents: Preferred Stock Deals

The Seraf Compass

MAY 22, 2024

This article is intended to provide a quick overview of the principal documents in a fundraising where the investors are purchasing stock.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Seraf Compass

MAY 22, 2024

This article is intended to provide a quick overview of the principal documents in a fundraising where the investors are purchasing stock.

The Seraf Compass

MAY 8, 2024

This article is intended to provide a quick overview and explanation of the principal documents in a fundraising where the investors are purchasing convertible debt. Unlike a stock transaction, these convertible debt deals do not alter the capitalization of the company by adding new stockholders until the debt is converted into equity.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

This is going to be BIG.

SEPTEMBER 13, 2012

Building collaboration tools is the next logical step after they've already built the only free open source depository of legal documents --similar to how Github isn't just a place to store your code, but to work on it with others. Features are nice, but this post is about the bigger vision. They suggest changes and discuss best practices.

TechCrunch

MARCH 9, 2021

Dropbox announced today that it plans to acquire DocSend for $165 million The company helps customers share and track documents by sending a secure link instead of an attachment. DocSend raises $8M for smarter document sharing. The company raised a modest amount of the money along the way, just $15.3

TechCrunch

JANUARY 24, 2022

Reviewing repetitive documents is, well, repetitive, but Klarity believes people don’t have to do all of that and is building an artificial intelligence tool, targeting finance and accounting departments, that turns documents into structured data. Document automation is not a new concept. Image Credits: Klarity.

TechCrunch

APRIL 19, 2023

But it was his experience as an accountant that led to his interest in the blockchain and how it can be used to verify documents. So far, it has processed 12 million verifications on 2 million issued documents and served 600 users. It creates a wallet, or document store, which is a smart wallet on the Ethereum network.

Both Sides of the Table

SEPTEMBER 10, 2021

how on Earth could the venture capital market stand still? One of the most common questions I’m asked by people intrigued by but also scared by venture capital and technology markets is some variant of, “Aren’t technology markets way overvalued? With the enormous changes to our economies and financial markets?—?how Of course we can’t.

TechCrunch

SEPTEMBER 15, 2022

Gaetano Crupi is a partner at venture capital firm Prime Movers Lab. You want to proactively manage the order in which people access information and focus their attention on a few key documents that they can return to when they fall down a rabbit hole. An elegant strategy memo is your most important document. Gaetano Crupi.

Both Sides of the Table

APRIL 6, 2020

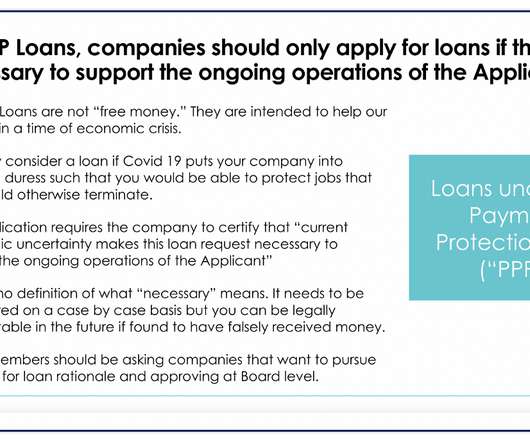

If your US-based business is adversely affected by Covid-19 such that you would need to lay off employees imminently and having access to capital would enable you to keep more employees on the payroll then you might be eligible. The NVCA (National Venture Capital Association) Guidelines are below. Am I eligible for the PPP Loan?

Dream It

APRIL 23, 2019

From using voice analysis to identify behavioral health issues to streamlining physician documentation of patient interactions, startups have incorporated voice technology to improve the value and efficiency of care. Physicians spend hours each week documenting their patient interactions in the EHR. Here’s a look at it:

Dream It

JULY 31, 2019

The product should be live if we hope to raise capital. A program to get your company 'accelerated'- selling faster, moving faster, which does not necessarily translate to capital. Don't get me wrong; the pitch deck is a crucial document (trust me, it's what we do). NOT spending time on the accelerator building the product.

Dream It

APRIL 7, 2020

You’ll learn insight to guide your PPP application process from our discussion with Jim Marshall (Silicon Valley Bank, SVB), Kathryn Hickey (PilieroMazza), and Duncan Davidson (Bullpen Capital), which is viewable in its entirety below. It depends on the bank’s capitalization level. Bullpen Capital has agreed to that.

Both Sides of the Table

NOVEMBER 20, 2012

Frankly, I think venture capital is that way, too. I am inspired by the constant innovation in our industry by First Round Capital like the Dorm Room Fund , their expansion to Philadelphia (I hope they also have a secret plot to replace Andy Reid while there), the exchange fund and other initiative. I know, I’m weird.

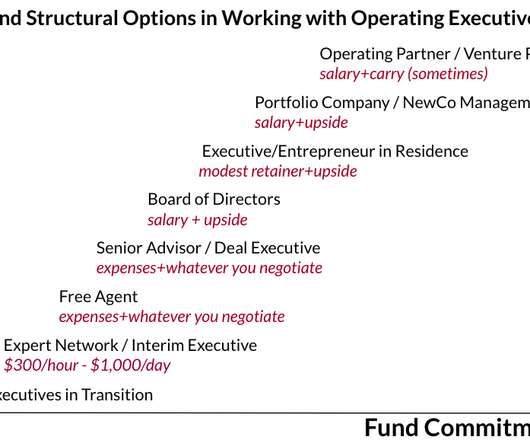

David Teten VC

SEPTEMBER 13, 2022

It’s hard enough to raise capital from VC, private equity fund, and family offices. I list the online communities for VCs in general at Reading list for working in private equity/venture capital. Be flexible: Try to not be dogmatic about formality, avoid complex agreements/signed documents. How do you sell to them?

Both Sides of the Table

MAY 21, 2017

I read it just after I entered the Venture Capital industry more than a decade ago. Since I had built 2 document management companies I knew all the reasons why building a document management company would “never work.” I remember when I spoke with Aaron Levie early in the days of Box. I see this often in investors.

Both Sides of the Table

SEPTEMBER 22, 2012

He also nails the reason why venture capital is still necessary to grow large businesses quickly in a world where the costs of running startups have fallen dramatically. After all, growth equals high valuations and loads of venture capital! It’s ok to raise venture capital and try to build a monster business.

Dream It

MAY 14, 2020

Net Health is a portfolio company of The Carlyle Group, Level Equity, and Silversmith Capital Partners. Clinicians will be able to capture and seamlessly upload wound images and other documentation, including automated measurements, to the WoundExpert platform. "In About Tissue Analytics Tissue Analytics, Inc. Tissue Analytics, Inc.

A VC: Musings of a VC in NYC

AUGUST 8, 2022

An alternative to a bridge is an “insider round” where the existing investors provide sufficient capital to fund the business for eighteen to twenty-four months. While that can sometimes be the right answer for a startup, I strongly prefer bringing new investors/new capital into a company in every financing round.

StartupNation

AUGUST 27, 2021

It’s an issue every entrepreneur and new business must face: raising capital for your business. While capital can come in many forms — debt or equity, private or institutional — this article focuses on raising equity capital. Whether you find the challenge of raising capital exhilarating or anxiety-inducing (maybe both!),

Both Sides of the Table

MAY 13, 2013

Almost certainly the startup would have raised some capital. And precisely because buyers usually prefer to have limited money go to investors – investors almost always have the ability to say “no” to transactions in the terms of their funding documents (aka “blocking rights”). I’m a VC.

TechCrunch

JANUARY 31, 2023

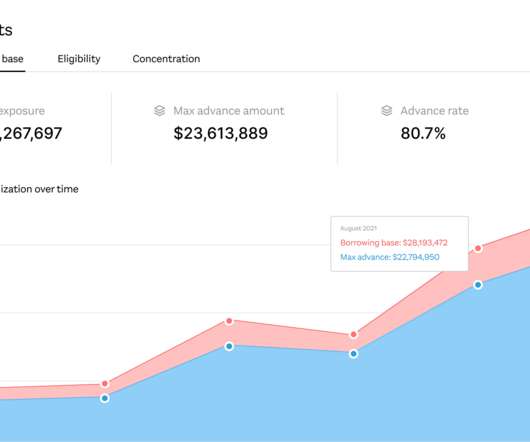

As venture capital investments slowed down in 2022 , some startups turned to private credit, including debt capital, as a way to supplement their operations in the meantime. He said interest in debt capital has grown, even among non-technology companies. Finley’s debt capital management dashboard.

David Teten VC

JUNE 9, 2021

Would you like to work with private equity and venture capital funds? There are relatively few jobs directly inside private equity and venture capital funds, and those jobs are highly competitive. Venture Capital. Asian Venture Capital Journal (free trial). Private Equity. Preqin (free demo). Grey House (free demo).

Dream It

JULY 29, 2020

TrekIT’s unique, clinician-designed platform improves provider wellbeing, helps teams find critical data they need, when they need it, while also increasing revenue for the health system by optimizing documentation workflows.” Investors echo the market opportunity and Dr. Airan-Javia’s vision for the company.

A VC: Musings of a VC in NYC

JANUARY 1, 2024

As we enter 2024, the capital markets have found their footing and are moving higher. That is good news for the innovation economy because healthy capital markets are a necessary support system. However, optimistic capital markets are necessary but not sufficient for a healthy innovation economy.

TechCrunch

MARCH 4, 2022

The D’Amelio family, including TikTok stars and digital creators Charli D’Amelio and sister Dixie , are formalizing their investments in startups with the launch of a new VC fund, 444 Capital. He and Renert had discussions about putting such a fund together, which has a similar focus as Tandem Capital. Image Credits: Step.

TechCrunch

APRIL 26, 2023

On the other hand, Appruve, which provides an API that verifies user identity, fraud detection and digital documentation, primarily focuses on new datasets that enable or complement traditional government data such as international passports and national IDs.

Entrepreneurs' Organization

FEBRUARY 8, 2023

My version of the Canadian dream involved capitalizing on the inclusivity of Canadian life,” said Lennert. I just feel so honoured and humbled to have my story documented,” Lennert reflected. And to have my life with my partner documented forever that way. He contemplated hanging up his wetsuit once again. It’s so special.”

Both Sides of the Table

NOVEMBER 9, 2014

Generally speaking in venture capital financings the legal documents will specify that only “major investors” (a threshold set in the agreement – which can be $500,000 investor or more). Does he blog about venture capital and try to advise entrepreneurs? Has written a book on venture capital. You betcha.

Both Sides of the Table

NOVEMBER 22, 2014

They seemed a little excessive in trying to make it hard for their competitors to raise capital. I was at the first pitch meeting they ever did to raise capital. They want us to store our documents. They were a little too fierce in their competitive practices against Lyft to sign up drivers. Journalist, train thyself.

Dream It

APRIL 12, 2020

Paul Martino, General Partner at Bullpen Capital. During our recent Dreamit Kickoff week, Bullpen Capital Founder and General Partner Paul Martino ( @ahpah ) spoke with our Spring 2020 cohort about the state of the VC ecosystem in the current economic crisis. Will a financial crisis affect how venture funds deploy capital?

This is going to be BIG.

JUNE 16, 2014

Theoretically, someone could meet you, sign your document, and write you a check for deposit that day, but that''s not how it usually works. Venture Capital & Technology' How long does it take from first meeting a VC to getting cash in the bank? That''s an interesting question.

Both Sides of the Table

AUGUST 17, 2015

The one thing I learned as a consultant (I worked at Accenture for 9 years in my 20’s) and working with bankers doing M&A transactions is that no matter how hard we worked there was always a lawyer who got handed the documents at 2am and had to turn them around by 8am in the morning.

This is going to be BIG.

JULY 25, 2022

The structure of the meeting should follow some kind of document. To lay the groundwork for accountability—where you say what your plans are and you can all huddle around your performance against that. Very quickly, those bullets turn into a few things: One or more hypotheses. How many is too many, for example?

Both Sides of the Table

JANUARY 2, 2014

Think about it – most of us accept the world of free-market capitalism in which of us acts as greedy individuals but the well-being is guided by an “ invisible hand ‘ the ends up maximizing benefits for society. Given how important people management is it’s surprising more of us don’t have group coaches.

Both Sides of the Table

SEPTEMBER 5, 2012

If I could persuade you that they’re already in these documents would you consider abandoning this structure? Those terms you fought so hard to get out of “clean term sheets” by using TheFunded, VentureHacks and the like are in your current documents. If we don’t raise a bone fide round of capital (say, $1.5

David Teten VC

FEBRUARY 17, 2025

If you are launching your own investment management firm, we recommend designing a constitution: a set of documents covering the firms goals, legal obligations, and principles for handling disagreement. At Coolwater Capital , the Y Combinator for VC funds, we assess this as part of our diligence process.

Andreessen Horowitz

FEBRUARY 13, 2024

Together, these documents will help distill not only your vision for the current fundraise, but more broadly the long-term differentiation and trajectory of your company. This is a simple table in which each row represents a spend category, and the sum of each row is roughly the quantum of capital which you are currently raising.

TechCrunch

APRIL 14, 2022

Filevine , a startup offering a software-as-a-service product for legal case management, today announced that it closed a $108 million series D round led by StepStone Group with participation from Golub Capital and existing investors Signal Peak Ventures and Meritech Capital. software-as-a-service market.” ” Future growth.

Both Sides of the Table

JULY 9, 2013

Or thinking about how much capital you have and therefore how many people you can hire – you rigorously prioritize. As a very early-stage startup person you’re used to rigorous prioritization on almost all other parts of your business because you likely work closely with product where these choice are natural.

Paul G. Silva

MAY 29, 2020

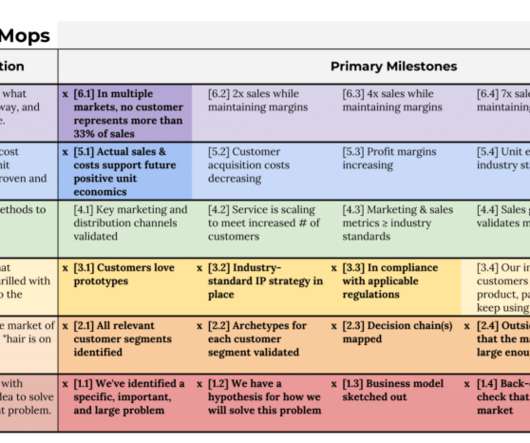

A few years later Village Capital took the IRL to the next level, creating the Venture Investment and ReAdiness Level (VIRAL). It is a fantastic tool to help highly scalable startups understand where they are at in terms of being ready to raise venture capital funding. In a Nutshell. Let’s take a look (click to enlarge).

Andreessen Horowitz

OCTOBER 4, 2023

Given the shifting landscape, it’s helpful for you as a CEO and/or founder—or for your finance and capital markets teams, if you have those hires to help you through this process—to know who the key players are at each stage so you can spend your time and energy speaking to the right firms. This usually takes about a week.

TechCrunch

FEBRUARY 13, 2021

The trading service’s investors came in force to ensure it had the capital it needed to continue supporting consumer trades. And then there were so very many cool venture capital rounds that I couldn’t get to this week. Of course, the Public round comes on the heels of Robinhood’s epic $3.4 This Koa Health round , for example.

Both Sides of the Table

FEBRUARY 1, 2015

In preparation for her reentry into VC she spoke with many mentors of hers for advice on venture capital. Document management? just click that link) was preparing for our annual meeting with our LPs. Kara worked in VC for more than 5 years but more than a decade ago. ” Such simple yet poignant advice. So you become jaded.

Dream It

SEPTEMBER 4, 2019

In theory, investing off the balance sheet from budgeted funds should be as effective as committed capital within a formal venture capital fund structure. Since salary is easier to cut than carry, top venture capital talent often shy away from CVCs. In practice, it rarely is. The best startups have their pick of investors.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content