Understanding How The Innovator’s Dilemma Affects You

Both Sides of the Table

NOVEMBER 4, 2010

Many people bandy about the definitions of “disruptive technology&# or “the innovator’s dilemma&# without ever having read the book and almost universally misunderstand the concepts. It should affect how you think if you are an incumbent but also if you’re a startup. It is often LESS performant.

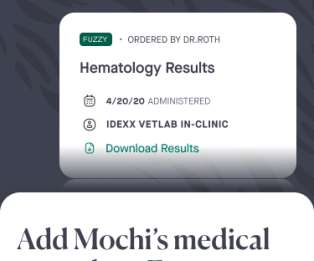

Let's personalize your content