Proptech in Review: 3 investors explain why they’re bullish on tech that makes buildings greener

TechCrunch

NOVEMBER 30, 2022

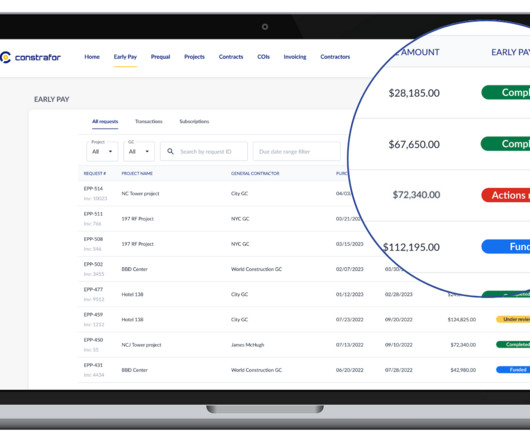

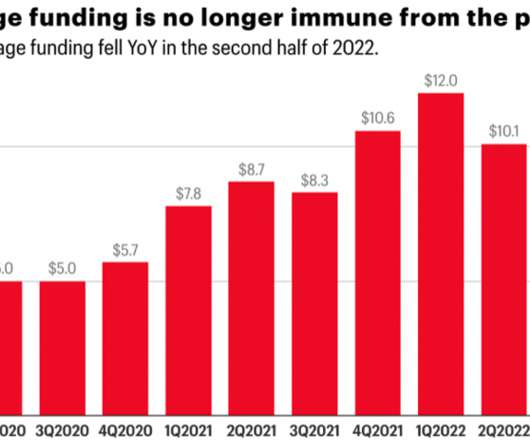

This economic environment will continue to test a lot of companies,” said Jake Fingert, managing partner, and Lionel Foster, investor, at Camber Creek. This economic environment will continue to test a lot of companies. Proptech in Review: 3 investors explain how finance-focused proptech startups can survive the downturn.

Let's personalize your content