Proptech in Review: 3 investors explain why they’re bullish on tech that makes buildings greener

TechCrunch

NOVEMBER 30, 2022

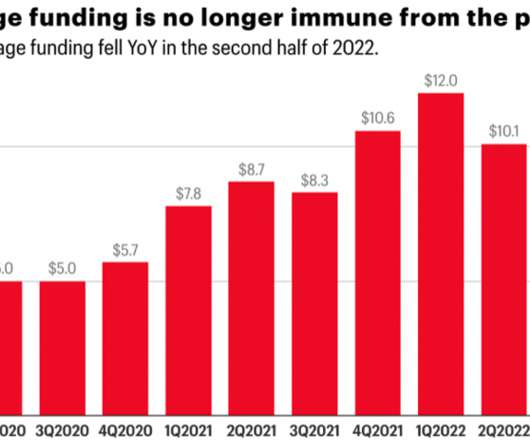

We asked three venture capital firms investing at the intersection of proptech and climate tech about how a focus on reducing emissions can trim a building’s carbon footprint and offer new opportunities for returns. Anja Rath , managing partner, PropTech1 Ventures. This economic environment will continue to test a lot of companies.

Let's personalize your content