Our Investment Framework Post-COVID-19

500

JUNE 9, 2020

The post Our Investment Framework Post-COVID-19 appeared first on 500 Startups. As society begins the delicate phase of re-opening, we have also given much thought to how.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

500

JUNE 9, 2020

The post Our Investment Framework Post-COVID-19 appeared first on 500 Startups. As society begins the delicate phase of re-opening, we have also given much thought to how.

Paul G. Silva

APRIL 1, 2025

He realized his responsibility wasn’t “keep developing the product” but “build a successful business ready for investment.” Within a few months, he secured investment that extended his runway by 18 months. ” This shift changed everything. The key is finding the right balance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

American Entrepreneurship

FEBRUARY 4, 2025

If you’re wondering how to design a scalable business model for your startup, this article is a guide through the process and offers strategies to ensure your company can adapt and expand efficiently over time. With the right strategies, you can build a business that thrives in good times and when faced with great challenges.

Both Sides of the Table

AUGUST 30, 2014

When I meet other VCs I’m constantly asking how they decide which investments to make, when to pass, when to do follow-on rounds, when to sell a company vs. when to go long, etc. Draw from Frameworks. The most helpful type of advice in my mind are frameworks for how to solve a problem. For example: 1. Triangulate.

Advertisement

This framework explains how application enhancements can extend your product offerings. Just by embedding analytics, application owners can charge 24% more for their product. How much value could you add? Brought to you by Logi Analytics.

Revolution

OCTOBER 31, 2024

Revolution Growth’s Latest Investment in Healthcare and AI: Pathos, the Company Re-Engineering the Drug Development Process The oversubscribed $62M Series C will be used to expand the team, accelerate platform development, and advance its clinical-stage pipeline of precision oncology therapeutics.

The Seraf Compass

MARCH 22, 2023

You know that many startups fail to take advantage of one of the best kept secrets of product management and company strategy, the customer council. If you’re invested in a growing company that does not yet have a customer council, you may want to encourage the founders to create one.

TechCrunch

DECEMBER 1, 2020

Should your SaaS startup embrace a bottom-up GTM strategy? David Cahn is an investor at Coatue, where he focuses on software investments. David is passionate about open-source and infrastructure software and previously worked in the Technology Investment Banking Group at Morgan Stanley. The MAP customer value framework.

Entrepreneurs' Organization

NOVEMBER 15, 2019

Glazer has established himself as a leader who invests in his team and in the culture of his organization. . Here, he shares his thoughts on capacity building as a leadership strategy. . For a deeper dive into how to invest in your team, check out EO 24/7. . I have gone all-in on capacity building as a leadership strategy.

Both Sides of the Table

MARCH 28, 2010

I did 5 years of building large computer systems and computer networks for global corporations and 3+ years as a “strategy consultant.&# In many of the meetings you’d meet clients who would tell you everything you needed to know, would offer to help you and then would never follow up on the help that they had offered.

Both Sides of the Table

AUGUST 29, 2012

And no wonder, lately he and his partners are on a tear, investing out of their $200+ million VC fund. They recently exited their investment in Gaikai for $380 million while their rival OnLive (who had raised > $200 million) just went through bankruptcy. I’ve laid out my policy on seed investing pretty clearly and publicly.

Both Sides of the Table

SEPTEMBER 8, 2009

I told people privately my perfect spec: computer science undergrad from MIT (or any other great school), 2-years at McKinsey but no more than that (I love the analytical framework that the top strategy consulting firms provide. I tell people regularly that I only invest in companies where the DNA is software.

Startup Blogpost

AUGUST 18, 2023

19 Strategies for Managing Risk in a Startup In this article, we explore nineteen different strategies for managing risk in startups, shared by founders, CEOs, and other industry professionals. This way, we made more informed decisions and reduced the risk of failure.

NZ Entrepreneur

NOVEMBER 19, 2024

While spreadsheets might seem sufficient in the early days, investing in a proper accounting system from the start can save you countless headaches down the line. This is super helpful for making smart decisions about your business, like whether to hire that extra hand or invest in that shiny new equipment.

TechCrunch

MAY 13, 2021

RIBS: The messaging framework for every company and product. Bottom-up SaaS: A framework for mapping pricing to customer value. David Cahn is an investor at Coatue, where he focuses on software investments. Bottom-up SaaS: A framework for mapping pricing to customer value. The hamburger go-to-market strategy.

Both Sides of the Table

SEPTEMBER 28, 2014

Let’s set up a framework. otherwise I prefer to invest less and risk less). But this strategy great depends on point 3. A Framework to Guide You: So putting it all together, you should always be mindful of your personal circumstances and market conditions. But what IS the right amount of burn for a company?

TechCrunch

FEBRUARY 4, 2021

They deliberately are not investment bankers or accountants because they do not want to constantly pour over endless spreadsheets or dive deep into financial models. The best way to succeed in this evaluation framework is to ensure that everything you share is relevant and exciting to a diverse audience of even nontechnical folks.

Both Sides of the Table

FEBRUARY 22, 2011

While there is no right or wrong answer, having seen the extremes I’d like to offer you a framework for considering the right answer for yourselves. So why else would they invest if not as an option to re-up in the next round? These are all dumb reason to invest – of course. I love that. And it’s kind of true.

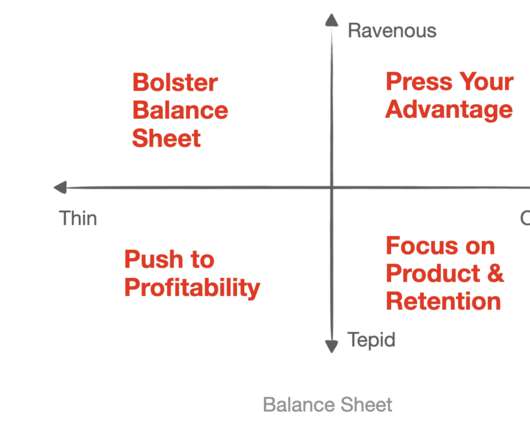

Tomasz Tunguz

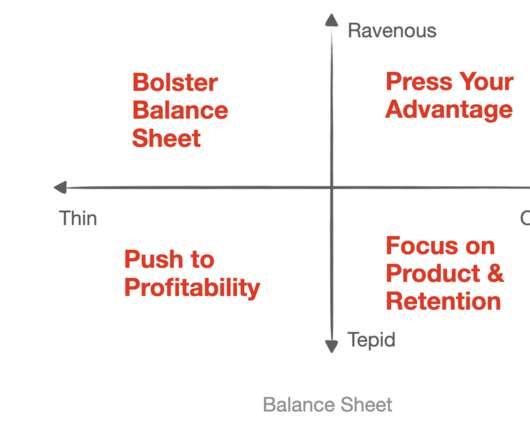

APRIL 16, 2020

Among the most useful frameworks I’ve found to manage a company in this era is the 2×2 matrix above. Both are equally viable strategies. Venture capital, debt, or negotiating better cash collections (multi-year prepay) are all viable strategies to position the business to press its advantage. Fortune favors the bold.

Dream It

APRIL 21, 2020

This framework helps founders position their fundraising targets and avoid red flags with investors. On the other hand, if your ask offers investors too little equity, the investors won’t have enough skin-in-the-game to achieve meaningful or target returns on their investment. This is a difficult question to answer.

Both Sides of the Table

APRIL 17, 2016

It is a hugely compelling show because Zakaria covers world issues that will affect all of us in ways that are accessible and with frameworks for processing disparate information. Whenever I’m looking at new investments I pay really close attention to verbal queues given between founders or management members.

AsiaTechDaily

OCTOBER 18, 2023

Register Japan’s Financial Services Agency plans to double the cap on the amount of money retail investors can invest in unlisted startups. At present, through crowdfunding, retail investors have a limitation of investing a maximum of 500,000 yen annually in individual unlisted startups.

A Smart Bear

SEPTEMBER 5, 2018

But some decisions should not be made in haste, like a key executive hire , or how to price , or whether to raise money, or whether to invest millions of dollars in a new product line. If you can’t easily undo the decision, it’s worth investing more effort into analyzing the likelihood of the upsides and risks. Huge effort.

Both Sides of the Table

DECEMBER 3, 2009

So I thought I’d try to lay out a framework for how you should think about it as many you will inevitably be faced with this experience. When times are bad many cease investment activity all together. Investing is our core business. One month after investing the guy who invested left his firm.

TechCrunch

JUNE 22, 2022

However, the segment is yet to record the type of investments that have poured into B2B retail e-commerce in the previous two years. But he contends that since most of these startups haven’t scratched the surface of a vast FMCG space, it’ll take a long while before they invest in B2B medicine distribution.

Revolution

FEBRUARY 17, 2021

Let’s use Morningstar’s 5 Factors as a framework. The framework was originally created to help public market investors determine whether or not an investment opportunity afforded a defensible moat that would contribute to a superior return-profile. When exploring an investment in a tech hub?—?i.e., What makes up a moat?

TechCrunch

JUNE 15, 2021

In particular, the group thinks Europe is still lagging behind when it comes to late-stage investments. The French government has been working on a way to foster late-stage funds and investments in public tech companies in France. “On The European Investment Fund is already pouring a lot of money in VC funds. or in China.

David Teten VC

AUGUST 19, 2019

A new wave of Revenue-Based Investors are emerging who are using creative investing structures with some of the upside of traditional VC, but some of the downside protection of debt. I believe that Revenue-Based Investing (“RBI”) VCs are on the forefront of what will become a major segment of the venture ecosystem.

A VC: Musings of a VC in NYC

JANUARY 5, 2020

These are two very different “go to market” strategies, they imply two very different business models, and they will result in very different long term market positions. But I can give you a framework because choosing what to invest in is a lot like choosing what to work on. One is an investment of money (and time).

Entrepreneurs' Organization

JANUARY 5, 2024

How to Run a Company With Two 10-Minute Weekly Meetings and Post-It Notes Barry Raber (EO Portland), a serial entrepreneur and CEO of real estate investment firm Business Property Trust , shared his insights on how to keep team meetings short and sweet with an effective system that fosters collaboration and engagement. But the No.1

Tomasz Tunguz

FEBRUARY 15, 2021

If I gave you $1000 to invest, and five investment options how would you decide? What if you were the CEO of a startup, and a VC invested $10m, and each of your five VPs had different project ideas? Kelly wanted to solve for two key ideas: avoid total loss: the investment strategy should never result in a 0 or negative balance.

Tomasz Tunguz

APRIL 16, 2020

Among the most useful frameworks I’ve found to manage a company in this era is the 2×2 matrix above. Both are equally viable strategies. Venture capital, debt, or negotiating better cash collections (multi-year prepay) are all viable strategies to position the business to press its advantage. Fortune favors the bold.

Dream It

JULY 20, 2020

Also, understand that investing in a bridge round is a very high risk. My seed round was just one fund, but they’re out of dry powder and can’t continue to invest. In just 5-minutes, you’ll learn and be able to avoid common obstacles founders confront while raising a bridge round.

TechCrunch

JANUARY 26, 2022

Latin Americans seeking the ability to invest in companies trading on the Nasdaq and New York Stock Exchange now have a new option in Vest, a startup that has launched a mobile-first brokerage app with zero-commission trading in the Americas. Financial services for investing and cash management in the U.S. Image Credits: Vest.

AsiaTechDaily

DECEMBER 19, 2022

intends to use the funding to investment in technology and scale its business operations and teams in the United States, India and the Middle East. It was also the first investment for Sorin Investments, an early-stage tech fund founded by private equity veteran Sanjay Nayar, Former Chairman of KKR India. Uniqus Consultech Inc.

This is going to be BIG.

OCTOBER 28, 2016

Telling your story isn't just about conveying information about your company--it's about giving someone a framework that makes them feel like they know how to be successful as well. HE/SHE] said, ‘I’d love to invest.’ [AND If anyone is ever going to write about you, you have to give them something to take away. Otherwise, who cares?

Both Sides of the Table

FEBRUARY 15, 2016

It’s a very personal topic and I’d like to offer you a framework to decide for yourself, based on the following factors: How Long is it Taking to Raise Capital at Your Stage in the Market? In our best deals we hope to invest $10-15 million over the life of the fund. Is that a lot for them? How risk averse are you?

AsiaTechDaily

SEPTEMBER 7, 2023

Their heightened interest is reflected not just in their demand for ESG reports but also in surging investment volumes. Data from the Global Sustainable Investment Alliance highlights a staggering 605% increase in Sustainably-Themed Investing in 2020 compared to 2016.

AsiaTechDaily

OCTOBER 4, 2023

Leading this financing endeavor were Japan’s venture capital firm, SBI Investment Co. and Global Hands-On VC (GHOVC), a collaborative venture capital entity with a track record of successful semiconductor investments that span the Japan-United States nexus. This approach adopted a software-first strategy.

TechCrunch

FEBRUARY 3, 2022

Kopetz says the company wants to continue to operate independently so it can work with multiple players in the industry, but that it’s happy for MotionWise to complement Aptiv’s strategy of providing smart vehicle architecture on its path to be a leading player in the software-defined arena.

David Teten VC

DECEMBER 3, 2019

However, in private markets, there is more room to optimize across all 11 steps of the investing process: firm management , marketing, fundraising , origination , manage relationships, due diligence, negotiation, monitoring, portfolio acceleration , reporting, and. The 11 Steps of Investing in Private Companies. 1) Manage the firm .

Dream It

SEPTEMBER 16, 2020

We brought on Caya (CEO of Slidebean ) to provide a smart framework on how to find the right cofounders that can hit this mark. Cofounders are willing to do it because they’re full invested in this.” The challenges you’ll face in finding cofounders will vary depending on which persona describes you.

Both Sides of the Table

FEBRUARY 27, 2011

I hope I straddled people’s points of view well enough not to have offended anybody while adding a framework for how I think about the service. Not an investment philosophy “ I understand the sentiment of this post and it’s how I view AngelList (like email), but I feel like it loses a nuance about AngelList.

TechCrunch

JANUARY 5, 2022

Startups have chief strategy officers, chief investment officers — even chief fun officers. It is an end-to-end governance framework focused on the risks and controls of an organization’s AI journey. Again, the EU is leading the way after releasing a 2021 proposal for an AI legal framework.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content