Playing the Long Game in Venture Capital

Both Sides of the Table

MAY 24, 2021

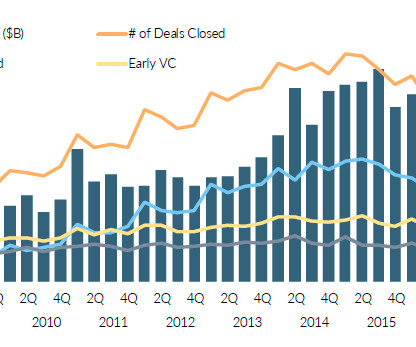

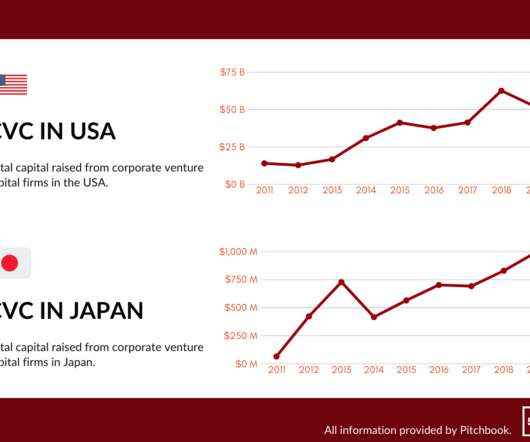

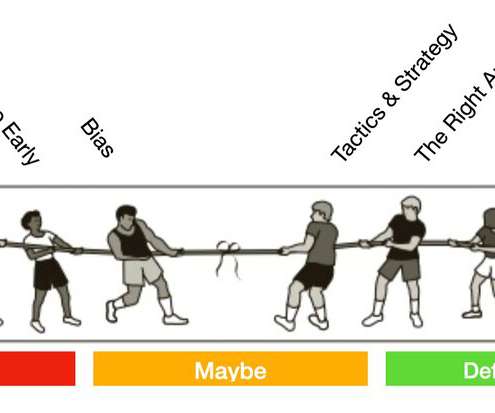

LPs Haven’t Yet Grokked the Long Game While the VC community realized 5ish years ago that short-termism in venture capital didn’t make sense and has capitalized on the scale advantages of letting companies go long, the LP community by and large hasn’t totally grokked this.

Let's personalize your content