This Week in NYC Innovation - February 22, 2010

This is going to be BIG.

FEBRUARY 22, 2010

Our high profile speakers come from the U.S.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

This is going to be BIG.

FEBRUARY 22, 2010

Our high profile speakers come from the U.S.

Both Sides of the Table

MARCH 24, 2014

In 2010 somebody posed the question on Quora, “Is Mark Suster a Successful Venture Capitalist?” Working with early-stage teams : coaching, mentoring, setting strategy, rolling up sleeves: 9/10. Helping companies get to next financing round successfully: I was just beginning this phase in Sept 2010 and said so.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

A VC: Musings of a VC in NYC

JULY 27, 2021

Our first Opportunity Fund, raised two years later in 2010, has generated only 3.9x That explains why our 2010 Opportunity Fund has a lower cash on cash return but a much higher IRR than our 2008 early-stage fund. But even for the same strategy, you can get materially different numbers. cash on cash but generated a 58.6%

500

OCTOBER 25, 2019

We believe the new corporate landscape calls for new strategies. Since 2010, we’ve. But the rate of change has accelerated and with it, the balance of internal versus external investment. As one of the most active, early-stage investors in the world¹, 500 Startups has a unique perspective on the innovation economy.

This is going to be BIG.

JUNE 16, 2014

The way I choose conferences and events, and my strategy once I''m there, is based more around who I''m going to back two years from now than it is who is raising now. If you meet someone at a pitch event, they''ve already got a company and they''re looking to close as quickly as possible. But does the data play that out?

Entrepreneurs' Organization

DECEMBER 1, 2021

After witnessing the financial crisis first-hand, Tim and I embarked on a new journey in 2010 by founding Elenteny Imports, offering innovative logistics services to buoy wine, spirits and beer companies during unprecedented times. Evolving into entrepreneurship.

Both Sides of the Table

JUNE 18, 2010

The strategy of GigaOm and where they differentiate in the market. Founded in April/May 2010 by Diego Berdakin (Ex-Slingshot Labs) and Josh Berman (Ex-Slingshot Labs, MySpace Co-founder) in Santa Monica, CA. first vertical to launch by 2010 Holiday Season. iAd platform was formally launches in July 2010 as part of iOS 4.

Entrepreneurs' Organization

MARCH 27, 2024

However, this perspective began to shift dramatically after 2010, thanks to technological advancements that facilitated remote collaboration. It revealed that post-2010, tools like Trello, Zoom, and Slack bridged the gap in remote collaboration, leading to a significant reduction in the innovation deficit previously observed in remote teams.

Both Sides of the Table

SEPTEMBER 27, 2010

I understand why he wants to differentiate himself but I wonder if a scorched Earth strategy against the main funding source for your company pays in the long run. But I wrote about one other point that I wrote back in March 2010 so it’s clear I didn’t just dream this up after today’s panel.

A VC: Musings of a VC in NYC

DECEMBER 31, 2019

Uber popularized this strategy and got very far with it, but sitting here at the end of the 2010s, Uber has not yet proven that it can build a profitable business, is struggling as a public company, and will need something more than capital to sustain its business. in 2010 to 7.7% now), and all but eradicated in China.

Both Sides of the Table

MAY 15, 2010

I asked some of the participating VCs, and they told me their attorneys had figured out a way to keep their stealth-mode companies stealthy.Yes, this strategy is not for every company. Doxo (November 2009 financing, just announced in May 2010 as company exited stealth mode). and who had biz reasons for wanting to remain stealth.”. -

A VC: Musings of a VC in NYC

MARCH 28, 2022

So I clicked on the link to my Competing To Win Deals post, which I wrote in 2010, and read it. Talk about the strategy issues facing the company. Here’s what I sent him: 1/ Startup = Growth by PG: [link] 2/ Competing To Win Deals by Fred Wilson: [link] pic.twitter.com/q7GG2k7UAX — Semil (@semil) March 27, 2022. Not this one.

Both Sides of the Table

SEPTEMBER 12, 2013

As more consumers were skipping commercials the idea of authentically integrating brands into media seemed obvious to me and ended up informing a lot of my investments in 2009 and 2010. Hamet is an extension of this strategy. The first such person to join us was Greg Bettinelli who came from eBay, LiveNation and then HauteLook.

500

SEPTEMBER 24, 2019

firms need to be thinking about their strategy to manage the trend towards globalization. back in 2010. As venture dollars increasingly shift towards being deployed outside of the U.S., 500 began making bets outside of Silicon Valley and outside of the U.S. Today, in 2019, 49% of our overall portfolio hails from outside the U.S.

Both Sides of the Table

JANUARY 28, 2012

Fred Wilson wrote two posts in 2010 that were very influential with the startup community. Here’s my view: I support a “mobile first” strategy for many companies. I think starting as an extension if your mobile strategy makes sense due to resource scarcity. The titles were: Mobile First, Web Second.

Both Sides of the Table

MAY 4, 2010

Segment One: Jim’s background and Clearstone’s investment strategy. 14mm in Series C; $25mm in Series B raised in March 2010; $44mm raised in total. Read more: SEC S1 Filing (amended 05-03-2010) , peHUB. Segment Two: “Deal of the Week”. Venture Partners, Grotech Ventures, Revolution LLC (Steve Case).

Both Sides of the Table

APRIL 28, 2010

It has proven a very successful strategy to get consumers to activate the payment on their mobile phone bill. 11.2mm in Series A, rumored pre-money of $35mm; $1.6mm angel raised in Jan 2010. Here’s why that is important: when users are on your website you want to convert them to become paying customers. Read more: TechCrunch.

Both Sides of the Table

NOVEMBER 19, 2015

What kind of firm do we want to be, how do we instill shared values, how do we handle generational changes, how do we onboard new partners, how does our strategy need to change given changes in market dynamics, etc. I mention all of this because this has been a journey that we at Upfront Ventures have thought a lot about over the years.

Haystack

JANUARY 18, 2020

At the start of 2010, there was some unwritten VC industry conventions that have been tested, challenged, and upended in the last decade. I don’t have the data, but I’d bet the “minimum ownership” requirements VC funds started 2010 with have gone down dramatically. What a difference a decade makes!

Both Sides of the Table

MARCH 17, 2010

’ &# His message was that in 2010 great business can be built anywhere if there is a great team and the will to make it work. We tend to do more $3 million “A&# rounds and we look for companies that have an early monetization strategy. I have one message for you, ‘get over it!’

Founders Coop

FEBRUARY 21, 2024

Just two years later, in 2009, we worked out a deal to create the Techstars Seattle program, with our first program running in 2010. The next important group to spot the weakness in Techstars’ strategy was the investment community.

Both Sides of the Table

APRIL 21, 2010

So it’s really hard to draw too many conclusions about whether the investment really makes sense because often you learn stuff in the fund raising about the future strategy of the company that might make you much more excited than somebody on the outside might be. Others I have not. LendingClub. 24.5mm in Series C.

TechCrunch

APRIL 6, 2022

The company has been around since 2010 and seems to have disclosed less than $24 million raised in that time, according to PitchBook data, while Crunchbase puts the total at $20 million. European firm Bregal Milestone is leading the round for Berlin-based Productsup, with previous backer Nordwind Capital also participating.

Both Sides of the Table

SEPTEMBER 14, 2016

We capped our fund size so that we would stay true to our investment strategy in terms of size, scope and number of partners as we stood in 2014 when we raised the fund. This was in 2010 — exactly the wrong time to be pulling out of venture. So you really want LPs who invest in the category in good markets and bad.

Revolution

MARCH 1, 2023

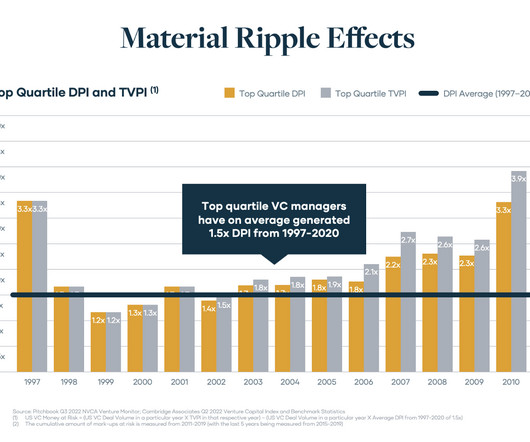

We looked at the analysis in two parts: the 1997–2010 time period and the 2011–2020 time period. 1997–2010 The chart above captured fund vintages that were fully-seasoned and had distributed most of their holdings. 2010–2020 We then looked at the top quartile fund performers for fund vintages since 2010.

Both Sides of the Table

APRIL 15, 2010

That said I worry that V1 of the strategy isn’t a home run. I don’t believe that search is the only answer in 2010 as it was in 2000. Especially when he’s surrounded by Danny Rimer (who funded Skype, MySQL, Last.FM and many, many more) plus Howard Morgan. I respect everybody involved in this project.

Entrepreneurs' Organization

SEPTEMBER 13, 2019

It isn’t 2010. To compete effectively, you more than likely need an aggressive digital marketing strategy, which requires full-time marketing efforts by experienced and knowledgeable marketers. When it comes to marketing, don’t make the mistake of assuming you can bootstrap your strategy. Not so fast.

Both Sides of the Table

NOVEMBER 25, 2010

I decided to put both of those issues to bed in 2010. In the corporate world this strategy is flawed. I came several times to NorCal (where I grew up, actually) and went and met several partners from each Silicon Valley firm. I didn’t want this to happen again – that people didn’t know me.

Both Sides of the Table

NOVEMBER 25, 2010

I decided to put both of those issues to bed in 2010. In the corporate world this strategy is flawed. I came several times to NorCal (where I grew up, actually) and went and met several partners from each Silicon Valley firm. I didn’t want this to happen again – that people didn’t know me.

Revolution

SEPTEMBER 29, 2022

While a few iconic brands including Uber, Airbnb, and Square emerged successfully from the last downturn, most venture-backed companies struggled during this period, and many ended up pursuing M&A strategies. Do these include detailed organizational design and hiring strategies? Is your IP fully scheduled and in digital form?

This is going to be BIG.

JUNE 19, 2012

Through our Brand Advocate Process, we plan , build, promote and monitor social media strategies that include "app-vertising". 8/31/2010 – Same thing. 12/11/2009 – Slight tweak: Now you use our tools to control your social media. We’re not doing it for you.

TechCrunch

NOVEMBER 16, 2022

This proved to be a winning strategy — at least at first. Between 2010 and 2015, Evernote raised hundreds of millions of dollars in venture capital from investors including Sequoia, Meritech Capital and Japanese media company Nikkei.

TechCrunch

AUGUST 11, 2021

One of the best strategies for tech companies that want to serve the older adult market is to focus your value proposition on empowering older adults. One of the best strategies for tech companies that want to serve the older adult market is to focus your value proposition on empowering older adults. billion in 2050.

Gust

OCTOBER 12, 2011

During the summer of 2010, I developed a workshop, A New ACEF Valuation Workshop for Angels and Entrepreneurs. See the 2010 data reported here: Current Pre-money Valuations of Pre-revenue Companies. See the 2010 data reported here: Current Pre-money Valuations of Pre-revenue Companies. million to $2.1 million to $2.7

Entrepreneurs' Organization

OCTOBER 2, 2019

Corporate social responsibility programs (CSR) and environmental strategies are taking center stage in the list of things exceptional candidates expect from a business. The report also highlights a popular post-2010 trend: Candidates now look for incentives such as paid secondments to work for social projects and needy causes.

Dream It

APRIL 12, 2020

Martino founded Bullpen in 2010 with a focus on post-seed, pre-Series A startups, and he led the fund’s investments in companies like FanDuel, Namely, Ipsy, SpotHero, Classy, and Airmap. VCs are going to be asking founders about their “post-corona strategy.” How should startups adjust their pitch when fundraising during this crisis?

Tomasz Tunguz

JANUARY 7, 2020

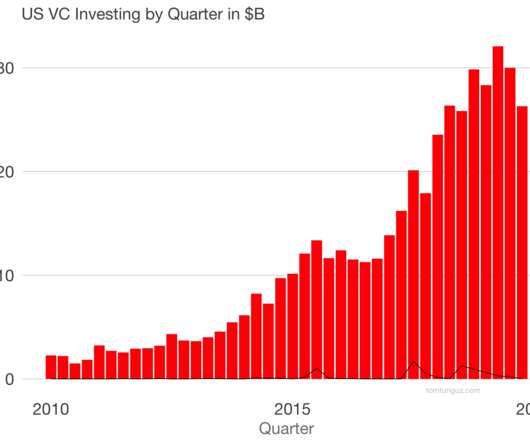

I wondered if Softbank's changes in investment strategy had much to do with it, but as the chart shows, they were not a meaningful contributor. Since 2010, the number of round by quarter has followed a periodic growth, with consistent seasonality. Mean round sizes have increased from 5 million in 2010 to 17.5

TechCrunch

DECEMBER 14, 2020

Before Monk’s Hill Ventures, Lim served as chief executive officer of Infocomm Investments from 2010 to 2013. “That’s always been a very explicit part of the government’s strategy to grow the tech industry.” “That’s always been a very explicit part of the government’s strategy to grow the tech industry.”

TechCrunch

OCTOBER 28, 2022

Founders shouldn’t let peer pressure or investor check size mandates dictate their financing strategy. Since 2010, the R-squared between exit value and total invested capital — a measure of how correlated the two variables are — for all healthcare exits is a paltry 0.34.

AsiaTechDaily

DECEMBER 5, 2023

Between 2010 and 2019 , healthcare spending in Singapore increased significantly, from SG$3.8 Singapore employs a range of strategies to balance costs and quality effectively. billion (US$2.846 billion) to SG$11.1 billion (US$83.15 Addressing these challenges requires innovative solutions and policies.

TechCrunch

MARCH 30, 2022

It has been profitable since 2010 — two years after its inception, meaning that it notched a net profit after taxes. We are gearing towards a crypto-first strategy…We’ve been at this for a long time and understand the requirements of the market, its dynamics and where the market is headed. Track record of growth.

TechCrunch

DECEMBER 22, 2020

Hipmunk (2010-2020). Mastercard also said IfOnly’s team and technology are still part of its Priceless experience marketplace: “The IfOnly platform will continue to help advance our Priceless strategy and our combined team will be even better positioned and equipped to deliver exclusive experiences for cardholders globally.”.

TechCrunch

MARCH 2, 2023

From 2010 to today, the number of GitHub users has exploded from 500,000 to 103 million. How to monetize open source There are multiple strategies for earning money from open source. Image Credits: GitHub Star History (opens in a new window) Let’s give some more context to the graph above.

TechCrunch

MARCH 31, 2021

Between 2006 and 2010, CEO Wilkerson, then a journalist and researcher, spent a great deal of time using motorcycles ( Boda bodas ) for quick and flexible transport. So in 2010, Wilkerson launched Own Your Own Boda, a for-profit enterprise to put these riders on a path toward owning their motorcycles.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content