The Future of Corporate Venture Capital

500

OCTOBER 25, 2019

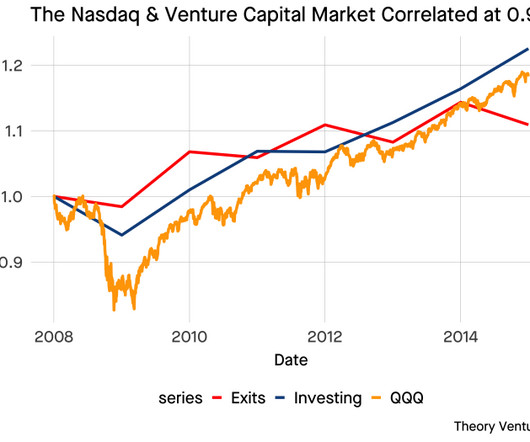

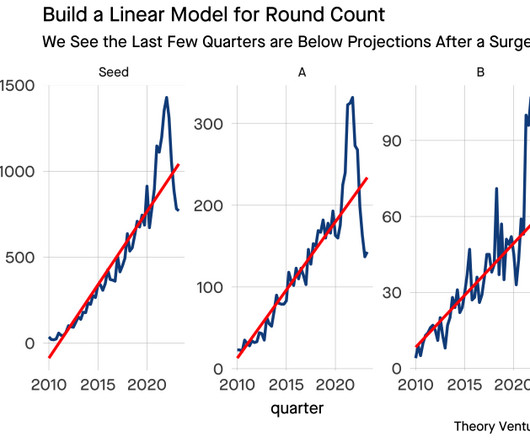

How has corporate venture capital changed? Since 2010, we’ve. The post The Future of Corporate Venture Capital appeared first on 500 Startups. The following is an excerpt from 500’s CVC report. We believe the new corporate landscape calls for new strategies.

Let's personalize your content