How I Got the Monkey Off My Back – Today Was a Good Day

Both Sides of the Table

MARCH 24, 2014

” So it’s now March 2014 – 5 years since I started investing. Here is the first 3 months of 2014 … . How is my scorecard looking?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

2014 Related Topics

2014 Related Topics

Both Sides of the Table

MARCH 24, 2014

” So it’s now March 2014 – 5 years since I started investing. Here is the first 3 months of 2014 … . How is my scorecard looking?

A VC: Musings of a VC in NYC

MAY 23, 2023

Back in 2014, USV got subpoenaed by the New York State Department of Financial Services (DFS) over our web3 investing activities. We hired a law firm, answered the subpoena, and that ultimately landed me in public testimony in front of the DFS staff.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Both Sides of the Table

OCTOBER 8, 2014

” in 2014 the data seems pretty conclusive because LA has now become the fastest growing tech startup region by numbers of companies being started and those of us here have noticed this pace accelerating. billion in venture capital to LA’s technology startups and 2014 will shatter that figure.

A VC: Musings of a VC in NYC

JULY 27, 2021

And our second Opportunity Fund, raised in 2014, has generated 7.3x Our 2014 Opportunity Fund has a higher cash on cash return but a lower IRR than our 2010 Opportunity Fund. Our 2008 vintage early-stage fund has generated about 5x cash on cash but only generated a 22.5% cash on cash but generated a 58.6% cash on cash but only 46.7%

Dream It

MARCH 20, 2020

NarrativeDX ( Healthtech - Fall 2014 ) is the latest win for the Dreamit portfolio. Today, the company announced that it is being acquired by health care performance improvement pioneer Press Ganey. Kyle Robertson, Founder and CEO of NarrativeDx. This comes on the heels of NarrativeDX’s recent funding round just one year ago last February.

This is going to be BIG.

NOVEMBER 3, 2014

— Charlie O''Donnell (@ceonyc) November 1, 2014. Love Slack, but $120mm and a $1B valuation at this point will almost certainly lead to lack of focus and less than optimal decision making. And then I promptly got Twitter flack from one of the people who works at one of the company''s investors. What was said, who''s right, etc.,

Both Sides of the Table

FEBRUARY 12, 2019

As you can see below the number of seed funds shot up dramatically between 2006 and 2014. With seed up massively between 2006–2014 and A and B rounds relatively flat what you see is a widening of the funnel going into traditional venture. So What Impact Did the Drop in Tech Founding Costs Have on VC?

Both Sides of the Table

NOVEMBER 28, 2013

You’ve had a few difficult years outside of work – I feel confident 2014 is going to be a great one! I know your 2013 success will lead to more sustained travel in 2014. I feel confident in our 2014 plans. Thank you especially to Jason & Eric.

Both Sides of the Table

JULY 23, 2014

Limited Partners or LPs (the people who invest into VC funds) have taken notice as 2014 is by all accounts the busiest year for LPs since the Great Recession began. It doesn’t take a huge leap to see how well the VC industry is positioned for the immediate future. But about that “bubble” we always hear about?

Young Leaders of the Americas Initiative

SEPTEMBER 28, 2020

Sadly, in 2014, when I relapsed for the second time since my initial surgery, the board of directors made the decision to terminate my tenure at ESTREC. Since its inception in 2014, ROAR has morphed into a wildlife rescue and rehabilitation organization, together with sanctuary services for nonreleasable animals.

Dream It

MAY 14, 2020

The Baltimore-based startup graduated from Dreamit’s Healthtech program in 2014. was incorporated in 2014 and is based in Baltimore, Maryland, with a satellite office in Kansas City, Missouri. Tissue Analytics, Inc. Tissue Analytics, Inc. Learn more about Dreamit Healthtech.

This is going to be BIG.

MAY 13, 2019

So, the extent to which any one fund will call out the other funds on the cap table that sat quietly on the sidelines for three years after Sarah Lacy called the company out in 2014 is going to be somewhat limited.

Revolution

MARCH 26, 2025

When our team first visited its startup community in 2014, the city had just declared bankruptcy, and people were not betting on an innovation-driven future. Take Detroit, for example. It was the Silicon Valley of its day, churning out the countrys most transformative technology: the automobile.

Both Sides of the Table

JANUARY 16, 2013

We’re excited to continue to grow our investment professional staff and will continue to do so over the course of 2013 & 2014 with our new fund. It made me realize that we’ve never properly introduced our associates: Graham Gelwicks. Jordan Hudson. Kevin Zhang. So what is an EIR and why Sam?

Both Sides of the Table

DECEMBER 14, 2014

But by 2014 much had started to change. We have witnessed one hell of a startup boom from 2009-2014 which has coincided with the boom in accelerators. Throughout 2012 & 2013 we funded many companies and then pulled together a second fund. Between the group of us we were probably helping launch 75-100 companies / year.

Both Sides of the Table

SEPTEMBER 28, 2014

by Michael Woolf that is worth any startup founder reading to get a sense of perspective on the reality warp that is startup world during a frothy market such as 1997-1999, 2005-2007 or 2012-2014. (it is also the title of a fabulous book from Internet 1.0

A VC: Musings of a VC in NYC

AUGUST 17, 2020

Crypto was helpful for me back in 2013 and 2014 when I was going through one of those periods. And the more the investment is of yourself, your time, your enthusiasm, the worse it is. I’ve gotten out of these periods of burnout by turning my attention to something else.

A VC: Musings of a VC in NYC

JANUARY 28, 2021

Had you done that in the summer of 2014, you would be looking at roughly 1,000 times your money right now. Whether it is crypto (Coinbase) or day trading (Robinhood), the retail investor now has the tools to get into the game and win the game. The new startup investing is buying into the Ethereum crowdsale.

Entrepreneurs' Organization

JANUARY 19, 2022

In 2014, I started working a cocaine trafficking case, which eventually led to the largest cocaine haul and most complex wiretap case in Nashville history. (I Five years of hard work later, I landed my dream job on the 20th Judicial District Drug Task Force.

Both Sides of the Table

JANUARY 8, 2014

Our theme for 2014 is “teach a firm to fish” where we build more scalable support for portfolio companies. We reinvented our annual meeting and now use the occasion to throw an LA Tech & Investment conference with hundreds of the best tech you’ll see in LA. And did I mention RELAUNCH A NEW WEBSITE !

Dream It

JULY 31, 2019

In mid-2014, Caya started Slidebean. The company then evolved into Saborstudio, a digital marketing consulting agency. In November 2012 Caya was selected as one of 40-Under-40 Costa Rican innovators, and he was a featured speaker on the 2013 TEDx PuraVida Conference.

Young Leaders of the Americas Initiative

MARCH 31, 2020

I put my ambitions of becoming an entrepreneur on pause for a couple of years until finally walking away from the corporate world in March 2014. I had no guidance at the time, so I didn’t know my ideas weren’t feasible and it was a very expensive lesson learned.

Both Sides of the Table

NOVEMBER 11, 2013

What’s mostly been keeping her busy in the last few months is onboarding our new CFO – Audrey Lee – and handling the 10-month buildout of our new Santa Monica offices, which are expected to come online in Feb or March of 2014. We have also hired Kyle Taylor to run platform services as his full-time job.

A VC: Musings of a VC in NYC

JUNE 27, 2022

The Gotham Gal and I own five EVs and have been driving electric-powered cars since 2014. I don’t drive gas-powered cars and haven’t for a few years now. We have purchased two Chevy Bolts, two Tesla Model Ss, and one Rivian truck.

Entrepreneurs' Organization

MAY 28, 2021

When I moved to Washington State in 2014, I initially registered my business as Julia L F Goldstein Communications. Maybe your business name is just your name and perhaps your credentials—Nancy Smith, CPA. Or perhaps you created a fictitious company name when you registered your business. If you didn’t, should you do so?

Young Leaders of the Americas Initiative

FEBRUARY 1, 2021

Before starting his own company, Boon’s Computer Repairs , in 2014 in St. Driven by a desire to help people from a young age, YLAI 2018 Fellow Janeel Boon aims to empower others to see their leadership ability within themselves. Kitts and Nevis, Janeel came from humble beginnings.

A VC: Musings of a VC in NYC

JULY 2, 2019

Facebook paid $2bn (or possibly more) for Oculus in the spring of 2014 and maybe a couple million Oculus headsets have been sold since then. If there is a technology that has overpromised and underdelivered more than AR/VR over the last five years, I am not sure what it is. So when is all of this investment going to pay off?

Both Sides of the Table

MARCH 6, 2015

. “There was no real framework for a $15 million fund at the time so I had to make one up … it was really sort of an experiment … I invested across Funds I & II in 90 companies” Jeff then raised $55 million in 2010 and $85 million in 2014.

Both Sides of the Table

DECEMBER 16, 2014

We also promoted Jordan Hudson to principal in 2014 and have encouraged him to begin looking at deals. Will our strategy change now that we have 40% more capital? . Whereas we had four partners investing Fund IV we now have six partners actively looking at deals for Fund V.

Both Sides of the Table

MARCH 14, 2015

Mark Suster (@msuster) November 7, 2014. And Twitter made that easy, so thank you). I have a couple posts queued up for next week – get them in your inbox https://t.co/YnJM8aeru9. YnJM8aeru9. So as a business I wouldn’t say Twitter needs to allow third-parties to port social graphs.

HPA

JANUARY 8, 2025

HPA led the first round of institutional capital in 2014, providing subsequent capital and strategic support to help drive growth and innovation. Founded in 2012 by Katlin Smith, Simple Mills is a market-leading natural foods brand offering premium better-for-you crackers, cookies, snack bars, and baking mixes.

Entrepreneurs' Organization

MARCH 17, 2021

million in DeepMind, and recouped over 80 times that amount when Google bought the company in 2014. It was enough to secure a formal meeting with Thiel, who went on to invest US$1.85 The post How entrepreneurs benefit from ‘Alien Thinking’ appeared first on THE BLOG.

Both Sides of the Table

NOVEMBER 5, 2014

Mark Suster (@msuster) November 1, 2014. The doubters will question you. The trolls will swipe at you. Competitors will undermine you. These are the signs of innovation.

Entrepreneurs' Organization

JUNE 14, 2022

Shonda Rhimes, Dartmouth, 2014. The award-winning producer focused her 2014 speech on the reality of her experience as an exceptionally busy working mom and the importance of doing, not dreaming. I have learned this the hard way, as I predict you graduates will, too.”. Watch | Transcript.

Both Sides of the Table

JULY 27, 2014

But here is the deck I used to present before our panel if you haven’t seen it already: Final 2014 pre money deck from Mark Suster. And we ended. Startup Lessons'

Both Sides of the Table

APRIL 27, 2014

I told my friend that I felt that in 2014 too many new VCs feel the pressure to chase deals, to be a part of syndicates with other brand names and to pounce on top of every startup whose numbers are trending up quickly. You could spent 20 days / year at Demo Days now.

A VC: Musings of a VC in NYC

AUGUST 22, 2019

Back in May 2014, Duolingo launched something called the Duolingo Test Center. Our portfolio company Duolingo is known for their super popular language learning app. According to Wikipedia over 300mm people all over the world have used Duolingo. The idea was to compete with expensive and inconvenient foreign language tests like TOEFL.

Entrepreneurs' Organization

APRIL 29, 2020

Ruchir Punjabi has been an EO member since 2014. If you already have stability, then this is an amazing opportunity to transform what you do, and thrive for what is certainly going to be a changed world after this crisis. For more tips on surviving the global crisis, visit the #EOTogether platform.

Tomasz Tunguz

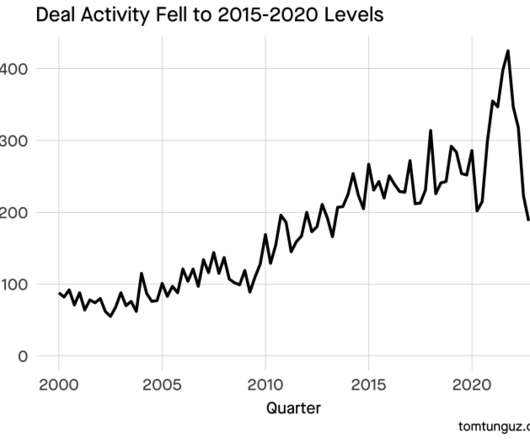

JANUARY 4, 2023

This change in the exit market parallels a surge in acquihires in 2014 when corporate development departments began to acquire seed-stage companies for talent rather than waiting for Series A businesses. During the 2013-2014, median acquisition prices increased by 50% in less than a year, from $36m to $54m.

A Smart Bear

JANUARY 4, 2018

We’ve come a long way from switching this blog to WordPress in 2009, my systematic vetting of the business idea in 2009 (after needing it myself due to the success of this blog crashing my dedicated server every time I got on Hackernews), the “ coming soon ” pre-launch in April 2010, our Series A 3-minute pitch in 2011, our incredible CEO Heather Brunner (..)

A VC: Musings of a VC in NYC

FEBRUARY 1, 2022

I wrote about this back in 2014 when I was buying 1.5 This is just a first step in a broader set of payroll products for employers and DAOs. I’ve always been a fan of “averaging into crypto” instead of trying to time the market. Bitcoin every week. That was back when you could buy a bitcoin for several hundred dollars.

Entrepreneurs' Organization

APRIL 20, 2020

In 2014, Greg contributed a chapter to Verne Harnish’s book, Scaling Up on how to improve profits though labor efficiency. Greg is currently the organization’s partner-in-charge of their Huntsville, Alabama office. In 2020, Greg will release his newest book, Simple Numbers 2.0: Rules for Smart Scaling.

Tomasz Tunguz

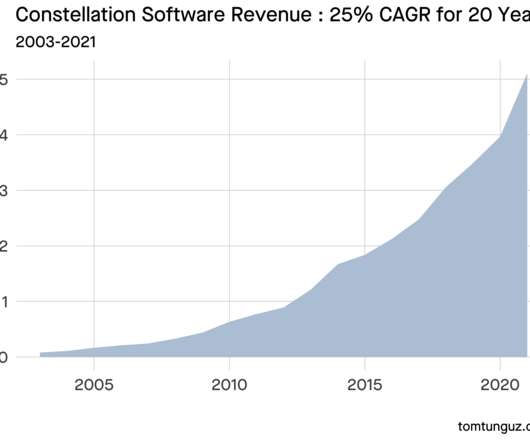

DECEMBER 26, 2022

From 2003 to 2014, Constellation’s revenues compounded from $80m to more than $5b, an average of 25% annually. In 2014, Constellation grew revenues 40%, which today would place the company in the top quartile. But Constellation arrives at that growth in a very different way : they acquire to grow.

TechCrunch

MARCH 3, 2023

In 2014, the startup almost ran out of cash. And when we almost ran out of cash in 2014, we were forced to become frugal and profitable.” Later, it scrambled with its product offerings after its marquee service struggled to make inroads, Zelto founder and chief executive Ankit Oberoi told TechCrunch in an interview.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content