A Guide To Angel Investing Documents: Preferred Stock Deals

The Seraf Compass

MAY 22, 2024

This article is intended to provide a quick overview of the principal documents in a fundraising where the investors are purchasing stock.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Seraf Compass

MAY 22, 2024

This article is intended to provide a quick overview of the principal documents in a fundraising where the investors are purchasing stock.

Entrepreneurs' Organization

AUGUST 31, 2022

The world is a big place, and companies wishing to invest have many domestic and foreign options. based companies invested in Germany in some way in 2021, almost matching the pre-pandemic total. Excluding sources of investments may alter the way a startup builds and shapes its culture. For example, 1,806 U.S.-based

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Seraf Compass

MAY 8, 2024

This article is intended to provide a quick overview and explanation of the principal documents in a fundraising where the investors are purchasing convertible debt. Unlike a stock transaction, these convertible debt deals do not alter the capitalization of the company by adding new stockholders until the debt is converted into equity.

Dream It

FEBRUARY 14, 2020

Matt Murphy and Grace Ge, Menlo Ventures Which trends are you most excited about in construction robotics from an investing perspective? We are active in construction with investments such as HOVER and Fieldwire and believe the entire sector is right for a digital and automation overhaul. About 10 percent of our time.

Both Sides of the Table

AUGUST 17, 2015

There is much discussion about this weekend’s article in the NY Times regarding Amazon’s work practices. For anybody who has never worked in a hard-charging environment I can see how this article portrays a unidimensional view of Amazon but it isn’t one I believe tells the complete story.

This is going to be BIG.

APRIL 14, 2014

Last week, there was a Business Insider article measuring the percent of female founded companies that NYC seed funds invest in. I guarantee you that if you ask any of the firms listed in the Business Insider article, and ask them if their dealflow is 15-20% women and they''ll say no. Well, it''s gotta mean something, right?

Founder Bounty

MARCH 25, 2025

We have already done the article is antler worth doing here and a lot of you are asking what exactly are the investment terms if they do offer you investment. This varies on the region but below are some of the key figures Investment Amount Antler typically invests $100,000 to $200,000 in pre-seed startups.

Entrepreneurs' Organization

JUNE 10, 2022

Contributed by Mike Stephenson, an EO Vancouver member who is co-founder and CEO of addy , which uses the principles of crowdfunding to make real estate investing accessible to everyone, including Black, indigenous, people of color, LGBTQ2S+ and other underrepresented groups. and more articles from the EO blog. .

The Seraf Compass

JANUARY 11, 2023

In Part I of this article we discussed several key concepts of fund investment strategy and how funds are categorized, whether it be by industry, geography, stage, specialty (e.g. social impact, corporate, etc.) or some other criteria. Now let's take a closer look at capital allocation strategy and the life cycle of a venture fund.

The Seraf Compass

AUGUST 23, 2023

In Part I of this article we talked about the challenges and responsibilities General Partners face managing a fund. Now let's take a closer look at the time commitment involved when you're ready to invest in a company, what's required when serving as a board director, and how GPs should handle communications with their LPs.

500

MAY 22, 2020

If we move to Georgia, we can save a fortune and get a further investment. Silicon Valley (Season 6, Episode 2) Yes, you heard it right – this is an article about Georgia, the country, not the state. The following post is written by Nato Chakvetadze, Program Associate for 500Georgia. Gavin: Here everything is so expensive.

Entrepreneurs' Organization

OCTOBER 15, 2024

That involves investing in training and education that emphasizes critical thinking, industry expertise, and communication. and more articles from the EO blog. Preparing for the Future of Idea Curation To thrive in a future dominated by generative AI, individuals, and organizations must prioritize the development of curation skills.

Both Sides of the Table

NOVEMBER 22, 2014

I didn’t invest in any of their fine competitors either like Lyft, Sidecar, Hailo, etc. This article had much resonance with me. ” Ironic that an article purporting to uncover a company with no training would publish pseudo journalism about the Uber experience. I’m not so sure. I wish I were. They don’t care.

Founder Bounty

MARCH 25, 2025

We have already done the article is antler worth doing here and a lot of you are asking what exactly are the investment terms if they do offer you investment. This varies on the region but below are some of the key figures Investment Amount Antler typically invests $100,000 to $200,000 in pre-seed startups.

The Seraf Compass

FEBRUARY 9, 2022

One of the hardest things about early stage investing is that it is really risky - if you don’t have some suspension of disbelief, and you obsess too much about cataloging every risk, you will never get a deal done. It is easy to talk about due diligence in the abstract, but it is much harder to practice what you preach.

Entrepreneurs' Organization

AUGUST 23, 2024

With marketing budgets tightening and businesses hurting, it made me want to share some of the most effective marketing strategies that have worked for us, either costing little to no cash or providing an absurd return on investment (ROI). and more articles from the EO blog.

Both Sides of the Table

JULY 7, 2015

” I found myself nodding through all of it with quotes like, “Seed investing is the status symbol of Silicon Valley,” said Sam Altman. I save room in literally every deal to invite angels (or seed funds) to co-invest with me. By March, a month after Mr. D’Angelo agreed to invest, CodeFights had raised $2.5 ” Uhhuh.

The Seraf Compass

DECEMBER 3, 2020

In those articles we talk a lot about the importance of having a good diligence report template to ensure the final report is useful to the reader. Here, for your reference, is our Impact Investing Due Diligence Report Template. We’ve published a fair amount about due diligence and being a deal lead.

Both Sides of the Table

MARCH 3, 2013

Let me start by saying that Clayton is one of the most influential people on my thoughts about markets that led to both the concept behind my first startup and my main theses in investing. VC can’t don’t invest in these kinds of companies because they can’t get out (no liquidity event). No minority shareholder.

Entrepreneurs' Organization

JUNE 21, 2024

But when my first article was published, I felt a huge rush of validation that maybe I do have something worth sharing. When I shared it on LinkedIn, people started liking the article, commenting how they loved my ideas and planned to implement them. Invest time to grow your following on the platform. Find a mentor to coach you.

The Seraf Compass

JANUARY 4, 2023

As a leading voice for professionalism in the early-stage investing community, Seraf provides extensive materials on all aspects of early stage investing. If you haven’t seen these pieces yet, we know you will enjoy checking them out!

Both Sides of the Table

SEPTEMBER 29, 2013

AngelList 101 : As you know, AngelList is a platform where angels can invest in semi-screened tech deals. As an angel you can look for the social proof in deals “Dave Morin is investing …” to make your decision. AngelList Syndicate leads don’t take any fees on the investment, which should help with returns.

Dream It

APRIL 2, 2019

Dreamit incorporates the intelligence, data, and new relationships gained during acceleration into its venture investment process to build a high-potential, diversified portfolio. Since 2008, Dreamit has worked with over 320 companies. And we like that the program has a stringent focus on customer acquisition.”

Both Sides of the Table

MAY 24, 2021

— @jasonlk How the Long Game Has Benefitted Upfront I was thinking about it this morning in particular and thinking about my own personal investment history. sold to Disney for $670 million and since our first investment was at < $10 million valuation we did quite well. Maker Studios?—?sold

A VC: Musings of a VC in NYC

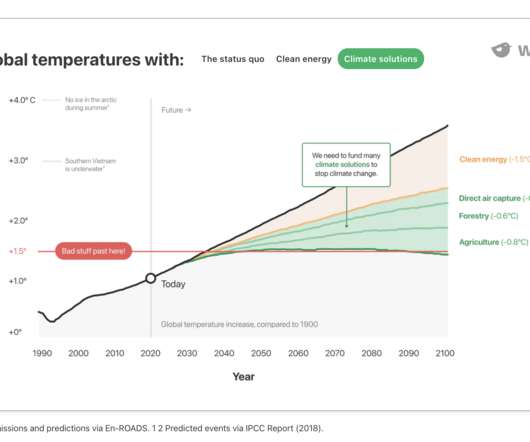

JULY 7, 2021

My partner Albert shared this article yesterday which suggests that the price of carbon will have to reach $150/ton by 2030 in order to create the conditions for the world to get to zero carbon by 2050. If you believe that will happen, you can profit from it by investing in the price of carbon.

This is going to be BIG.

NOVEMBER 15, 2020

Even after Fowler’s article came to the forefront and investors Freada and Mitch Kapor broke ranks with their silent co-investors in their now-famous open letter , things didn’t get better. I want every company I invest in to be a great working environment, and if it isn’t, tell me what I can do about it. They got worse.

Entrepreneurs' Organization

AUGUST 4, 2020

This article comes from the Melbourne chapter of the Entrepreneurs’ Organization. Facebook ads remain our highest return on investment” 3. We promote articles, videos and quotes or infographics. For Facebook, they invest by placing ads. “We According to some estimates, there are 3.80

Entrepreneurs' Organization

JUNE 19, 2024

When you invest in your business with your own money rather than investment dollars, you pay attention to every penny. The so-called J-curve of business growth — a period marked by initial investment losses before the eventual upturn — was a dark and isolating time. and more articles from the EO blog.

The Seraf Compass

SEPTEMBER 13, 2023

In Part I of this article we talked about the challenges and responsibilities General Partners face. In Part II we took a closer look at the time commitment involved when you're ready to invest in a company, what's required when serving as a board director, and how GPs should handle communications with their LPs.

American Entrepreneurship

MARCH 16, 2025

SoftBank Vision Funds investment reflects our shared commitment to leveraging advanced technology to drive the future of renewable energy, said Matt Campbell, CEO of Terabase Energy. Addressing the Energy Storage and Onshoring Boom This investment in Terabase arrives at a pivotal time in the renewable energy sector.

Entrepreneurs' Organization

FEBRUARY 16, 2024

When I started to research this article, my working title was How to break geographic self-bottlenecking. Renée Rouleau (EO Austin), wrote a great article about her 25 Lessons in 25 Years , detailing lessons her entrepreneurship journey taught her. and more articles from the EO blog. As we say in America, “The sky’s the limit!”

Entrepreneurs' Organization

SEPTEMBER 30, 2020

I also look into who I invest my time with, who I invite to join me on my life journey, and what I need to engineer in my environment so that I achieve my goals in structured and date-stamped manner (rest and relaxation included). A version of this article originally appeared on Kym Huynh’s blog. and more articles from the EO blog.

Both Sides of the Table

JANUARY 11, 2014

There’s an article making the rounds in tech circles titled “ Growth Hacking is Bull ” written by Muhammad Saleem. I’d like to make the case that the article is wrong. I’d strongly encourage you to read it. Avoid the spin, stay heads down and deliver the goods. Success begets success.

Both Sides of the Table

MARCH 14, 2013

This article originally appeared on TechCrunch. But through expressing points-of-view I can raise above the consciousness of my customers (entrepreneurs and limited partners who invest in VC funds) in ways that I couldn’t without breaking through the noise of the hundreds of others of VCs who also have money.

Entrepreneurs' Organization

AUGUST 5, 2022

The first two MyEO DealExchange conferences in 2018 and 2019 made a significant impact on the members who attended—including a 7-figure investment in Scott Mesh (EO New York)’s company. Each person gets 90 seconds to share the details of the investment opportunity or the “deal need” they’re presenting or seeking.

Both Sides of the Table

SEPTEMBER 1, 2016

Scott Kupor of A16Z responded with a comprehensive overview of valuation methodology in a post that while accurate feels more targeted at sophisticated Limited Partners (LPs) who invest in funds. What about those RETURNS the WSJ article spoke of? What’s an LP to do in deciding which funds to invest in? We can’t know.

Entrepreneurs' Organization

MARCH 8, 2024

Women still only get about 2% of venture capital investment money, and we want to see that change,” said Cindy Boyd, EO Houston. “By I approached several EO women colleagues and nCourage Investment Group was born. I also love seeing women introduced to the world of early-stage investing.”

Andreessen Horowitz

MAY 30, 2024

“I remember reading an article…where they measured the efficiency of locomotion for all the species on planet Earth. And the condor won. Humans came in about a third of the way down the list, which was not such a great showing for the crown of creation. But somebody had the imagination to test the efficiency of a human riding a bicycle.

Both Sides of the Table

NOVEMBER 5, 2014

” In the article is cites: Page estimates that only about 50 investors are chasing the real breakthrough technologies that have the potential to make a material difference to the lives of most people on earth. But “what is wrong with tech investing today?” 99% of the articles about the company were positive.

The Seraf Compass

SEPTEMBER 4, 2024

In this article, we'll explore the importance of effective angel group management and how it plays a crucial role in creating a supportive and productive environment for all members.

Both Sides of the Table

OCTOBER 26, 2014

In that article I talked about how PR drives: recruiting, employee retention, biz dev deals, funding and even M&A and that often “attribution” to your PR activities is unknown. Who cares if they know what you’re delivering today – that’s all about execution. I do it myself. If I can do it – so can you.

The Seraf Compass

OCTOBER 17, 2019

Angel investing started to break into the mainstream in popular American culture in the early 2000s. It started with stories of individuals striking it rich from investments in companies like eBay, Yahoo, PayPal and Google.

Entrepreneurs' Organization

JANUARY 21, 2020

In part 1 of this article, Tim discussed the false assumptions driving B2B innovations that fail. According to Accenture, 80 percent of B2B companies try to innovate around CX , but fail to generate a satisfactory return on investment. What does it take to design innovative digital customer experiences that predictably win?

Both Sides of the Table

MARCH 19, 2013

This article initially appeared on TechCrunch. The era of VCs investing in successful consumer Internet startups such as eBay led to a belief system that seemed to permeate many enterprise software startups that hiring sales or implementation people was a bad thing. I believe it’s flawed. I believe it’s flawed.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content