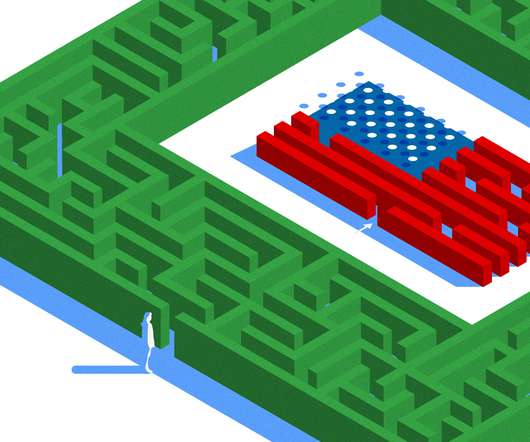

The VC tide has gone out. A real innovation wave is now arriving.

Founders Coop

SEPTEMBER 30, 2024

Building a generational company from scratch is the hardest thing you can do in capitalism. But VC bubbles deflate slowly. The only thing growing faster than GenAI adoption is the capital budgets of foundation model competitors. Will selling AI tools to incumbents prove more valuable than “full-stack” competitive attacks?

Let's personalize your content