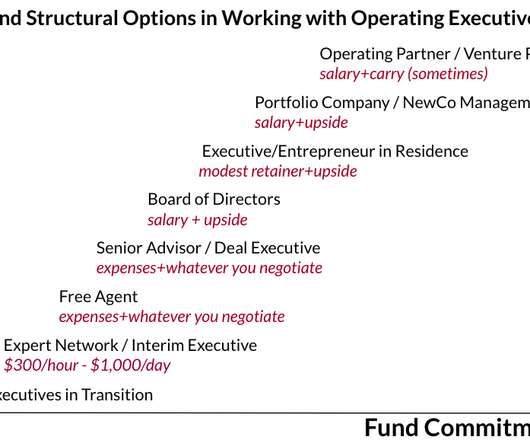

The Changing Structure of the VC Industry

Both Sides of the Table

JULY 23, 2014

The VC market has right-sized (returned back to mid 90′s levels & less competition). But it still takes VC to scale a business (thus large capital into industry winners like Uber, Airbnb, SnapChat, etc). But it still takes VC to scale a business (thus large capital into industry winners like Uber, Airbnb, SnapChat, etc).

Let's personalize your content