The Social Subsidy of Angel Investing

Startup Catalyst Brief Submitted Articles

NOVEMBER 4, 2020

Startup Catalyst Brief Submitted Articles

NOVEMBER 4, 2020

Every entrepreneur believes in their heart that their startup is more innovative and creative than their competitors. Yet none knows exactly.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Startup Catalyst Brief Submitted Articles

NOVEMBER 4, 2020

Startup Catalyst Brief Submitted Articles

NOVEMBER 4, 2020

Amid the coronavirus outbreak, angels are telling founders to scrutinize their sales forecasts, hiring plans, costs and every other assumption about their business.

Advertiser: ZoomInfo

AI adoption is reshaping sales and marketing. But is it delivering real results? We surveyed 1,000+ GTM professionals to find out. The data is clear: AI users report 47% higher productivity and an average of 12 hours saved per week. But leaders say mainstream AI tools still fall short on accuracy and business impact. Download the full report today to see how AI is being used — and where go-to-market professionals think there are gaps and opportunities.

Entrepreneurs' Organization

AUGUST 18, 2020

Is your business struggling due to the pandemic? You’re not alone. Around the globe, entrepreneurs are creating new ways to stay afloat —and that includes reaching out to clients and prospects in new ways. While business may be slow, client outreach must never slow. If you can keep customers engaged at times like these, you’ll earn even greater loyalty in the long term.

Startup Catalyst Brief brings together the best content for the entrepreneurial ecosystem from the widest variety of industry thought leaders.

This is going to be BIG.

AUGUST 30, 2020

Talk to ten founders and ten different VCs and you’ll get roughly about 600 different suggestions as to how you should go about your fundraising strategy. I don’t know what the formula is here, but the numbers and the resulting amount of confusion gets big very very quickly. Why does it seem like there’s an exception to every rule? You’re told that you can’t raise until you have a product, yet pre-product companies get funded all the time.

INBIA

JUNE 17, 2020

The post Virtual Incubation and Acceleration Services: What Really Works? appeared first on InBIA.

Dream It

MARCH 6, 2020

Jeff Berman is General Partner at Camber Creek , one of the first venture funds dedicated to real estate technology and the built world. The team owns, operates and manages over 150 million square feet of real estate, making Camber Creek one of the biggest value-add venture partners for real estate tech startups. Berman comes from a real estate background, and he co-founded Camber Creek after realizing an opportunity to “create a double alpha situation,” both investing in high-growth startups an

A VC: Musings of a VC in NYC

OCTOBER 12, 2020

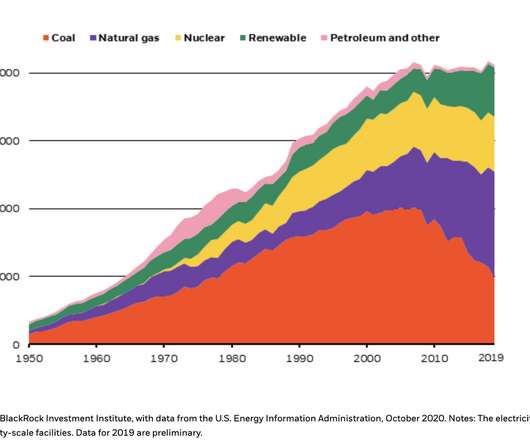

Over the last decade, the Gotham Gal and I have moved away from oil and gas in our homes and have installed solar panels for electricity and heat pumps for heating and cooling. It has gotten less expensive to do this swap out as solar and heat pump costs have come down. My partner Albert told me that when you factor in the financing costs of this swap, the average home in the Northeast United States could save $1000 to $2000 a year by doing this swap.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Both Sides of the Table

OCTOBER 26, 2020

Today we’re announcing that my partner Kara Nortman is becoming Co-Managing Partner at Upfront Ventures and I can’t tell you how thrilled I am to welcome her to her new role. As with all promotions, the reality is that Kara was already acting as a senior leader at our firm and also in the industry at large. She had all of the skills and traits we sought?

500

MARCH 26, 2020

No one would’ve envisioned me as a venture capitalist. I was raised in rural Wyoming, far from the high stakes and deep pockets of Wall Street and Silicon Valley. But from a young age, going against the grain was in my DNA. It’s what led me to San Francisco, and, ultimately, what drew me to 500 Startups. When I moved to San Francisco in 2012, I was working on my fourth startup and looking to join an accelerator. 500 immediately stood out to me, not only for their reputation as one of the top acc

Venture Well

MAY 26, 2020

Customer interviews help entrepreneurs discover if their idea is worth pursuing before putting a lot of time and effort into it. The post customer interviews: tips, do’s, and don’ts appeared first on VentureWell.

The Seraf Compass

AUGUST 20, 2020

Some investors will tell you after spending 60 minutes with an entrepreneur they know in their gut whether to make an investment. They rely on their instincts and sometimes their ability to “pattern match” with successful opportunities and entrepreneurs they worked with in their past. At the other end of the spectrum, there are investors who will spend countless hours digging into every aspect of a startup company.

Advertisement

Gearing up for 2025 annual planning? Our latest eBook from the Operators Guild is your ultimate guide. Discover real-world solutions and best practices shared by top CFOs, drawn directly from discussions within OG’s vibrant online community. Learn from senior executives at high-growth tech startups as they outline financial planning strategies, align CEO and board goals, and coordinate budgets across departments.

Young Leaders of the Americas Initiative

JANUARY 15, 2020

By luck when he was young, Alex Solano took an English language course that would change his life. One inspiring teacher forever changed the way that Alex viewed education, and he received a scholarship to continue taking courses on teaching English. His drive and passion for education eventually led him to establish an innovative English language school in Costa Rica, where he now provides life-changing courses to his community.

Entrepreneurs' Organization

APRIL 1, 2020

Remember when owning a small business was risky but rewarding? Stressful but satisfying? And then COVID-19 hit. In the midst of a global pandemic, being responsible for your own business—as well as the livelihoods of your employees—very likely seems overwhelming if not completely debilitating. Nobody said entrepreneurship was easy, but certainly nobody predicted this devastating turn of events.

This is going to be BIG.

OCTOBER 12, 2020

I don’t really have a particular goal with this post. I’m just sharing. When I started leading deals at First Round Capital, I sourced investments in 8 companies. GroupMe, Singleplatform and Backupify all had really good exits, especially if you’re just looking at the multiples of the pre-seed/seed rounds, which is what I’m focused on now. I found GroupMe at the Techcrunch Disrupt Hackathon.

A VC: Musings of a VC in NYC

SEPTEMBER 17, 2020

I have written extensively on this blog over the last decade and a half about the significant negative consequences that the two large mobile operating systems have on distribution of software. I am strongly opposed to the monopolies that Apple and Google have over mobile apps that run on iOS and Android. I am rooting for Epic/Fortnite in their battle with Apple over the 30% tax that Apple charges developers for distribution in their app store.

Advertisement

Mighty Financial specializes in supporting the financial aspirations of small businesses and entrepreneurs. With our comprehensive bookkeeping and precise accounting expertise with decades of experience across diverse financial roles, our team offers tailor-made services ranging from essential bookkeeping to strategic fractional CFO support, catered specifically to the unique challenges of technology companies, startups, and SMEs.

Entrepreneurs' Organization

MAY 18, 2020

Whether your business has remained open, scaled back, temporarily closed, or even ramped up during the coronavirus pandemic, there’s one thing we all have in common: Commerce as we knew it has—perhaps forever—changed. The organizations that adapt their policies, processes and customer outreach to meet the needs of this new normal will survive and grow stronger.

Entrepreneurs' Organization

JULY 6, 2020

Contributed by Rizwan Virk , author of S tartup Myths and Models: What You Won’t Learn in Business School. The pandemic of 2020 has tested most sectors of the economy. Like the downturns in 2008 and 2001, this has been a very trying time for entrepreneurs running startups. Many entrepreneurs are reliant on outside funding, whether angel investors, venture capitalists or strategic investors , to keep the venture going.

This is going to be BIG.

MARCH 22, 2020

I remember looking at other people on the street the day after 9/11. Everyone was just so sad. It was a shared moment in time where nothing needed to be said, and all we could muster was a slight nod to acknowledge that what you were feeling, everyone else was feeling, too. It felt like things would never be the same. Yet, it wasn’t very long after before I was on a plane.

A VC: Musings of a VC in NYC

OCTOBER 15, 2020

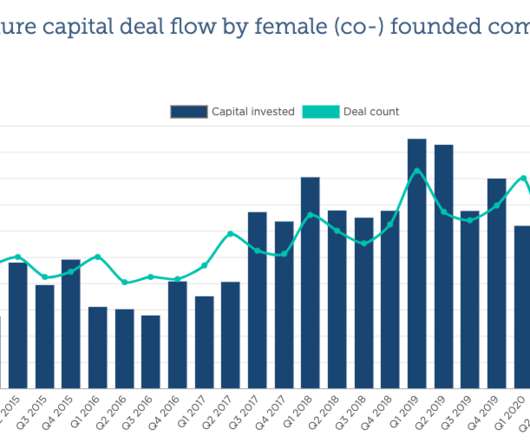

I wrote yesterday , about the quarterly numbers for VC investing activity: If this was a student coming home with a report card, it would be straight As. Well, I missed something in the data that was subsequently reported on by PitchBook , one of the authors of the report: Venture funding for female founders has hit its lowest quarterly total in three years.

Advertisement

Lack of digitalization decreases business competitiveness. To thrive, embracing modern solutions becomes essential. The approach to digitalization often aligns with a company's business model. This shift not only boosts productivity but also automates processes and improves security. The tech market offers a wealth of technologies tailored for management, planning, and forecasting, replacing outdated pen-and-paper methods.

INBIA

MARCH 26, 2020

The post Open Entrepreneurship Ecosystems: Resilience through Collaboration appeared first on InBIA.

Entrepreneurs' Organization

MARCH 18, 2020

The below article is part of Robert Glazer’s LinkedIn Newsletter series and originally appeared on Glazer’s LinkedIn page. He is the founder and CEO of Acceleration Partners , an affiliation marketing company. As COVID-19 spreads globally, many countries—including the United States—are mandating extreme social distancing measures. People are being urged to work remotely, schools have been canceled for weeks at a time and public gatherings are being discouraged, if not prohibited.

A VC: Musings of a VC in NYC

FEBRUARY 20, 2020

Earlier this week I purchased 1% of a collection of five 1985 Nike Air Jordan sneakers using our portfolio company Otis’ mobile app. I paid $330 for ten shares (out of a total of 1000 shares) implying a value of $33,000 for the five pairs, or roughly $6600 each. This page shows the highlights of this sale, including a video, a link to the investment deck, and a link to the offering circular.

Entrepreneurs' Organization

AUGUST 27, 2020

Agonise over whether or not you need business partners. Ai-Ling Wong—founder at The Decorateur. If you can afford it, don’t have business partners. Nine out of 10 entrepreneurs I know have long-term pain with their partners. The tenth entrepreneur without the headache is usually the one without a business partner.

Advertisement

CAPTARGET presents a masterclass in M&A deal sourcing. Learn to cast a wide net, embracing seller self-identification. Consistency is the linchpin: keep the origination process steady for a reliable flow of opportunities. Diversify your tactics, employing various tools and vendors. Tech matters! Understand DNS settings, domain authority, and brand presence for optimal outreach.

Let's personalize your content