Kristin Marquet, Founder, Tech/Analytics/PR Expert, Academic Finance Background, Marquet Media

Startup Blogpost

OCTOBER 14, 2024

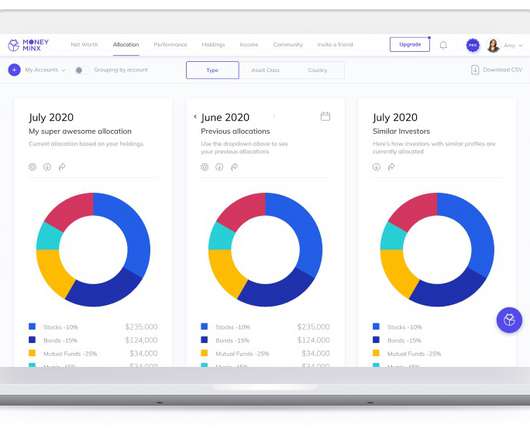

This interview is with Kristin Marquet , Founder, Tech/Analytics/PR Expert, Academic Finance Background at Marquet Media. To prepare, entrepreneurs should stay updated on these technologies, invest in scalable and secure solutions, and focus on creating seamless, user-friendly experiences.

Let's personalize your content